Piyush Agarwal (2024). WIN MASSIVE IMPACT PVT. LTD., SEO ORB. State of the Escape Room Industry Report 2024, Owner’s Survey. Available at https://winmassiveimpact.com/er-industry-report-2024/

Viewing Recommendation: For the best viewing experience, we recommend using a Desktop, Laptop, or large-screen Tablet. While the survey can be viewed on mobile devices, the layout and readability are optimized for larger screens.

Explore the Survey Results

You can read the State of the Escape Room Industry Report 2024 (Owner’s Survey) right here on this page, but if you’d like to access the data in different formats, choose one of the options below:

About the Surveyor

Piyush Agarwal, the founder of Massive Impact and SEO ORB, has been actively involved in the escape room industry since 2018. With experience consulting and collaborating with numerous escape room businesses on their marketing strategies, he has become a trusted advisor in the field. Piyush has conducted the State of the Escape Room Industry Survey three times, nearly biennially, with a focus on delivering transparent, impartial, and objective insights. These reports are independently produced, free from any external influence or obligations, ensuring the integrity of the findings. His goal is to support the growth of the escape room industry by sharing knowledge and helping businesses navigate challenges.

You can connect with Piyush on LinkedIn or Facebook for further insights.

INTRODUCTION

In the past two years, the escape room industry has undergone significant growth and transformation. The global market underwent robust post-COVID growth—with a valuation of $7.9 billion in 2022 and projected to reach $31 billion by 2032. This resurgence has been driven by a growing demand for experiential entertainment and the industry’s ability to adapt and innovate in an increasingly competitive landscape.

Market Growth and Expansion

The popularity of immersive, interactive experiences has led to a surge of new entrants and the expansion of existing businesses within the escape room industry. Corporate team-building events and themed experiences based on popular media have further fueled this growth, making escape rooms a staple in the evolving entertainment market.

However, this rapid expansion has also introduced unique challenges that businesses must navigate to stay competitive and profitable.

Challenges and Opportunities

Clearly, the escape room industry has withstood economic pressures such as high interest rates and inflation. Challenges like market saturation and operational difficulties do persist, but they also open the door to new opportunities for innovation. Staying ahead of the competition through better experiences, superior customer service, and improved positioning through strategic marketing is becoming increasingly crucial.

Shifting Consumer Preferences

One of the most significant drivers of growth in the escape room industry is the strong demand for immersive storytelling and cinematic experiences. Collaborations with entertainment franchises have brought new, visually stunning elements to escape rooms, making them more engaging than ever. Additionally, escape rooms are increasingly being used for purposes beyond entertainment, such as corporate team-building exercises and educational experiences, which has further broadened their appeal.

Geographic and Demographic Insights

The geographic reach of escape rooms continues to expand, with the U.S. leading as a major market, offering diverse themes and experiences. Europe and Asia have also seen substantial growth, driven by cultural interests and tourism (source).

Escape rooms attract a wide variety of participants, including friends, families, and corporate teams, due to their focus on mental challenges rather than physical demands. This versatility makes escape rooms accessible to a broad audience. Before exploring the survey results that reflect the current state of the escape room industry, it’s essential to first understand how escape rooms fit within the broader entertainment ecosystem.

NOTE: Please note that Questions 2, 28 and 29 were removed from the final report as they either contained personal information or were not important for the final report.

Escape Rooms and the Reality Gaming Industry

Escape rooms have become a popular form of entertainment, but their exact categorization within the broader industry has been a topic of discussion. Traditionally, they have been classified under either the Entertainment Industry or the Themed-Entertainment Industry. However, these labels don’t fully capture the immersive, interactive experiences that escape rooms offer.

The concept of the Reality Gaming Industry (*first seen in the 2019, State of the Escape Room Industry Report*) offers a more fitting classification for escape rooms, as they combine real-world and artificial elements to create engaging, life-like scenarios that challenge participants both mentally and physically. Unlike traditional entertainment, Reality Gaming involves active participation, where players are not just observers but are fully immersed in solving puzzles and interacting with their surroundings.

What is Reality Gaming?

Reality Gaming refers to the application of real-world and artificial elements to create immersive environments where participants are not mere spectators but active players. Unlike video games, where players passively observe, Reality Gaming involves them directly in the action. Escape rooms are one of the core experiences within this industry.

Other forms of Reality Gaming include Questing, Scavenger Hunts, Treasure Hunts, Augmented Reality (AR), and Virtual Reality (VR) games. These experiences are characterized by their ability to blur the lines between fiction and reality, creating environments that stimulate both the mind and body.

Escape Rooms as Reality Gaming

Escape rooms are prime examples of Reality Gaming. Players are placed in a dramatic scenario where they must solve puzzles, uncover clues, and complete challenges to achieve a specific goal—whether escaping a room, solving a crime, or completing a mission. Although the term “escape room” might imply participants are physically locked in, many escape rooms do not actually “lock” participants inside; they are free to exit at any time.

The strength of escape rooms lies in their immersive environments, which draw participants into a storyline that feels real, yet is designed to challenge their cognitive and collaborative skills. This blend of immersion, problem-solving, and teamwork places escape rooms at the forefront of the Reality Gaming Industry.

Why we ran the survey; what did we want to find out?

This year’s survey aimed to gather insights on key aspects of the escape room industry, focusing on business challenges, technological advancements, marketing strategies, and operational trends. Here’s what we set out to learn:

1. Business Challenges

We wanted to understand the top concerns for escape room owners in 2024. From inflation to labor shortages and customer spending patterns, we asked operators to share the biggest obstacles they face in running their businesses.

2. Technology and Tools

Innovation is essential for staying competitive, so we explored the kinds of locking systems, escape room management software, and other technologies businesses use. By asking about everything from RFID and magnetic locks to augmented reality (AR), we aimed to get a sense of how escape rooms are enhancing their player experiences through tech.

3. Marketing and Customer Engagement

Marketing plays a critical role in driving traffic to escape rooms. We sought to find out which marketing strategies have been adopted in the past six months, whether through social media efforts, collaborations with influencers, or updated websites. Additionally, we looked at how businesses are building customer loyalty, such as through promotional merchandise and expanded group booking options.

4. Pricing and Financial Strategies

With inflation affecting many industries, we wanted to know how escape rooms are responding. Have they raised prices? If so, how has that impacted their bookings compared to 2023? We also asked about overall pricing strategies and how businesses are adjusting to the current economic climate.

5. Staffing and Recruitment

Staffing remains a key issue, so we wanted to learn more about how businesses are recruiting talent. From job boards to employee referrals and social media platforms, we asked operators to share their best sources for finding and retaining staff in 2024.

6. Industry Sentiment and Future Outlook

We sought to gauge the overall sentiment within the industry. Are escape room operators seeing growth or is the market plateauing? We asked about their predictions for the future, whether they see the industry expanding or facing challenges like market saturation and regulatory pressures in their local areas.

Outreach and Data Validation

We gathered data from multiple sources, including web scraping and manual research, and reached out to businesses through various channels like email, social media, and industry partners. To ensure accuracy, we filtered incomplete responses and reviewed data for consistency.

Outreach

We began by compiling a comprehensive list of escape rooms using a combination of web scraping and manual data collection. Our key sources included:

- Google Maps and TripAdvisor directories

- Escape room-specific platforms like REA’s list of Escape Rooms in US, World of Escapes and the Morty App

Once we had a robust list of businesses, our team performed manual checks to ensure the data was up to date. We verified contact information and cross-referenced with other directories to avoid redundancies.

To get responses, we deployed a multi-channel outreach strategy:

- Email outreach to verified business owners

- Posts and interactions in Facebook groups such as Escape Room Startups and Owners

- Direct messaging on platforms like LinkedIn and Discord

- Collaboration with industry partners who helped amplify the survey within their networks

NOTE: No paid compensation was received from any individuals or companies to conduct this survey. While we have received anonymous donations, these contributions were made voluntarily and without any influence on the content or direction of the survey. Our industry partners, who helped amplify the survey within their networks, are independent entities. They have no involvement in the formulation of the questions or the final report.

Data Validation

Once responses were collected, we implemented several steps to validate and clean the data:

- Time-based filtering: We eliminated any responses that were completed in under 7 minutes, as our internal tests showed that meaningful participation required at least this time.

- Spam filtering: We removed entries that were incomplete or displayed signs of non-serious participation. This included responses with irrelevant or nonsensical answers, overly vague feedback, or inconsistencies in responses that suggested the survey was not taken seriously.

- Cleaning the data: We then thoroughly reviewed the final responses, carefully categorizing open-ended qualitative feedback into common themes. This process helped us extract meaningful insights while ensuring consistency in the data.

These steps allowed us to ensure that the 364 responses used in our final analysis were genuine and reflective of the current state of the industry.

Some Key Findings from the Survey of 364 Escape Room Owners

- Reduced customer spending and higher wage bills are the top concerns for escape room owners.

- Inflation is also a key concern for 44.2% of businesses, which have already raised prices to keep up, while 31% are considering similar measures.

- 24.5% of businesses reported somewhat higher bookings compared to 2023, 24.5% reported somewhat lower, and 31% reported about the same.

- 41.5% of businesses believe the industry is growing slowly, while 41.2% feel that growth is plateauing, with concerns of market saturation and increased competition in some areas.

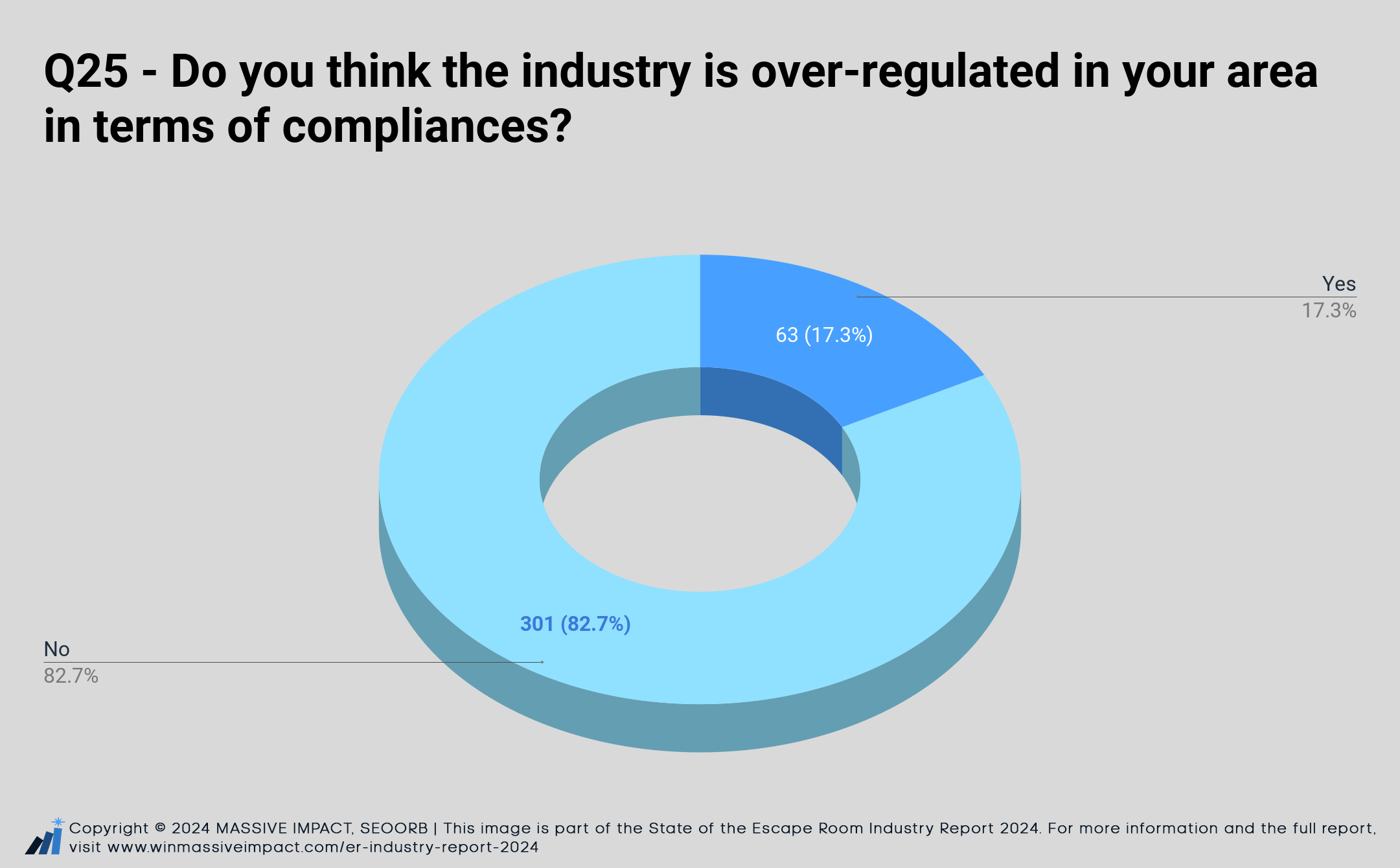

- 82.7% of respondents do not feel the industry is over-regulated in their area.

- 9.9% of businesses don’t use surveillance cameras in their escape rooms.

- There’s a shift towards more immersive and technologically advanced experiences.

- 7.4% have implemented Augmented Reality (AR) and 4.1% use Virtual Reality (VR).

- The industry is seeing a divide between high-end, premium experiences and more budget-friendly options.

- 50% of respondents have not utilized professional marketing services.

- Underutilized recruitment methods like company websites, newsletters, recruitment agencies, and internships offer opportunities for more diverse hiring strategies.

- 40.1% rely on employee referrals and word of mouth for hiring.

THE SURVEY RESULTS

About our respondents

| # | Country | Count |

|---|---|---|

| Grand Total | 364 | |

| # | Continent | Count |

|---|---|---|

| Grand Total | 364 | |

Survey Response Types:

- Single-Choice Questions – Respondents could select only one option from a list of predefined choices.

- Multiple-Choice Questions – Respondents could select one or more options from the provided list. The total number of responses may exceed the number of participants, as multiple selections were allowed.

- Open-Ended Questions – Respondents provided free-text responses in a text box. These can either be standalone questions, where only a text response is required, or part of multiple-choice questions, where respondents can add a custom response in addition to selecting predefined options.

Business Overview

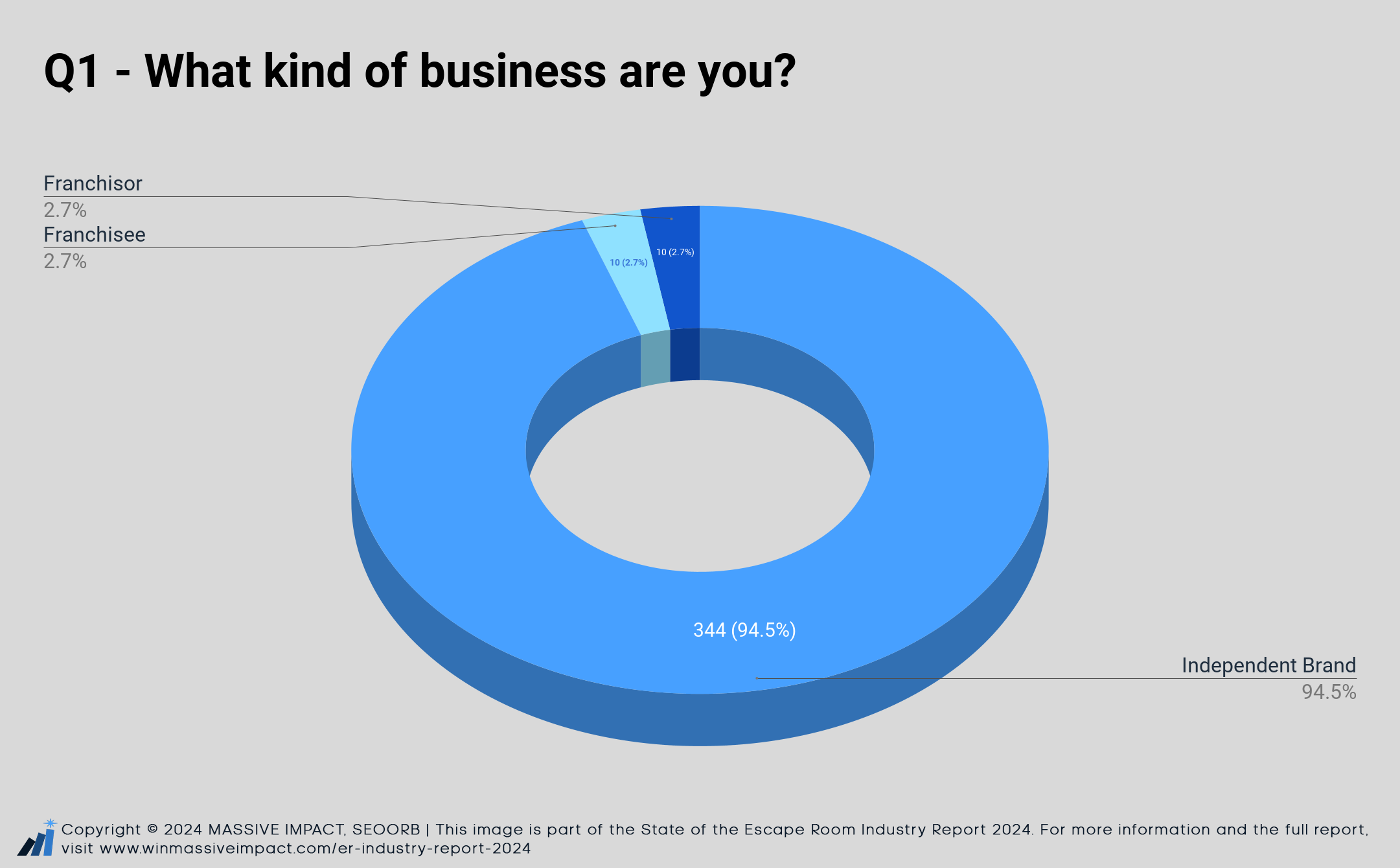

Q1 – What kind of business are you?

Single-Choice Question.

Participants: 364

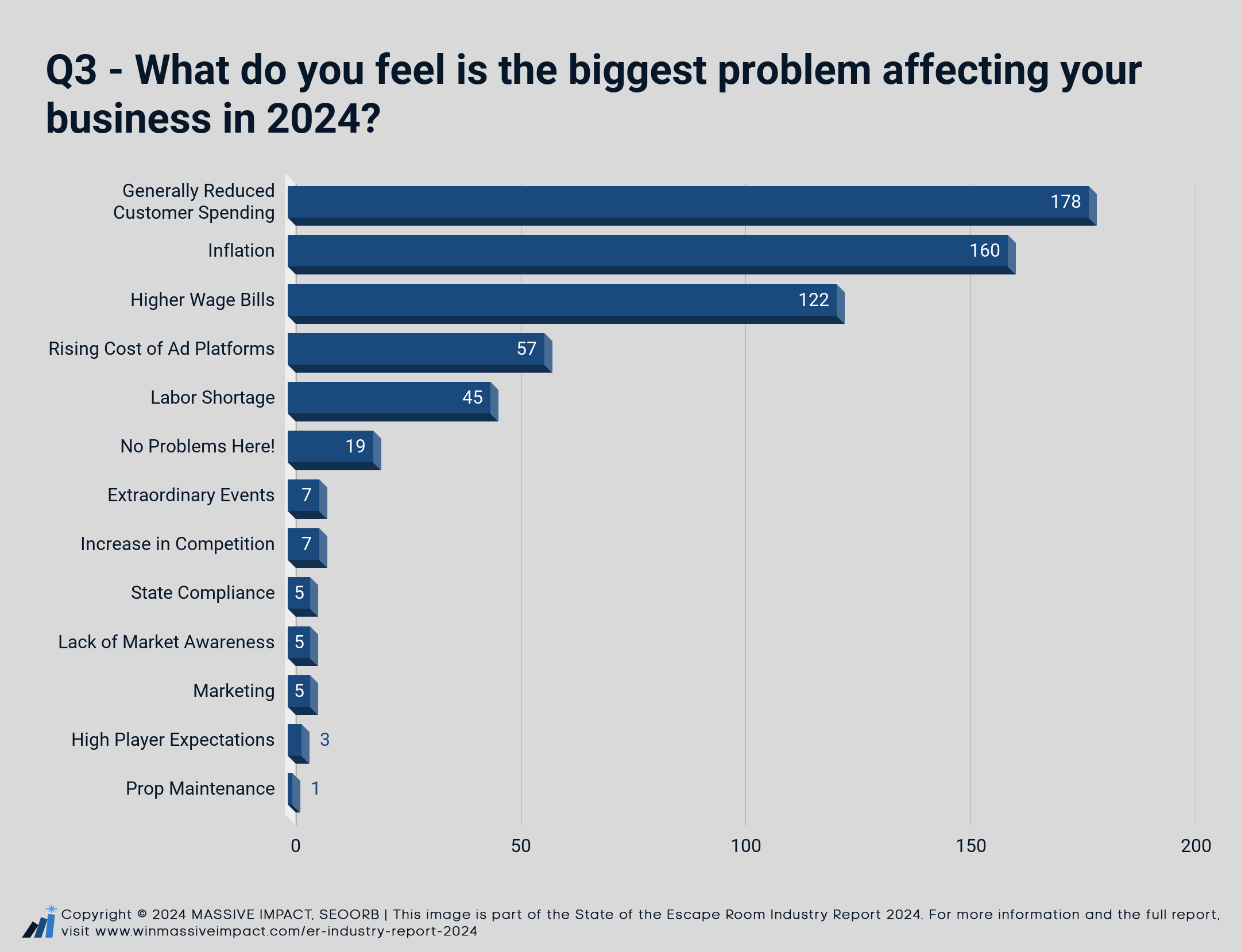

Q3 – What do you feel is the biggest problem affecting your business in 2024?

Multiple-Choice Question with an Open-Ended Option.

Participants: 364

Inflation has emerged as a major hurdle, with 160 businesses citing it as a primary concern. This economic pressure has led to higher operational costs, forcing many owners to make difficult decisions about pricing and staffing. Compounding this issue, 122 respondents reported higher wage bills, further squeezing profit margins.

Perhaps most concerning is the widespread report of reduced customer spending, with 178 businesses identifying this as their biggest problem.

The industry has also had to adapt to changing marketing landscapes, with 57 respondents noting the rising cost of ad platforms. This has forced businesses to reevaluate their marketing strategies, with many turning to social media and community engagement to attract customers.

Additional Insights based on answers to other questions:

Despite these challenges, the industry shows resilience. Many businesses have responded by innovating their offerings, with some incorporating new technologies like VR and AR, or diversifying into related entertainment options. Others have focused on enhancing customer experience and building community connections to foster loyalty and word-of-mouth marketing.

As the industry moves forward, it faces a critical juncture. The businesses that can navigate these economic pressures while continuing to offer compelling, high-quality experiences are likely to emerge stronger, potentially leading to a more mature and resilient escape room market in the future.

Additional Insights from Owners

The survey also revealed several unique challenges faced by escape room owners that couldn’t be easily categorized.

- Last-minute bookings are becoming a norm, replacing the pre-pandemic norm of advance reservations. This unpredictability complicates staffing and resource allocation.

- The shift towards private games since COVID-19 has impacted revenue streams, altering the traditional business model for many venues.

- Some owners express concern about customers being exposed to low-budget, poorly designed games as their first escape room experience, potentially harming the industry’s reputation.

- Balancing the time needed to build new rooms while operating a busy business presents a significant challenge for many owners.

- There are indications of market saturation beginning to take effect in some areas, increasing competition and pressure on existing businesses.

- Delays in new room construction, potentially due to supply chain issues or financial constraints, are hindering growth and innovation for some businesses.

- Owners report challenges in making business plans due to fluctuating operational costs and labor shortages. Overestimating increases expenses, while underestimating leads to missed revenue.

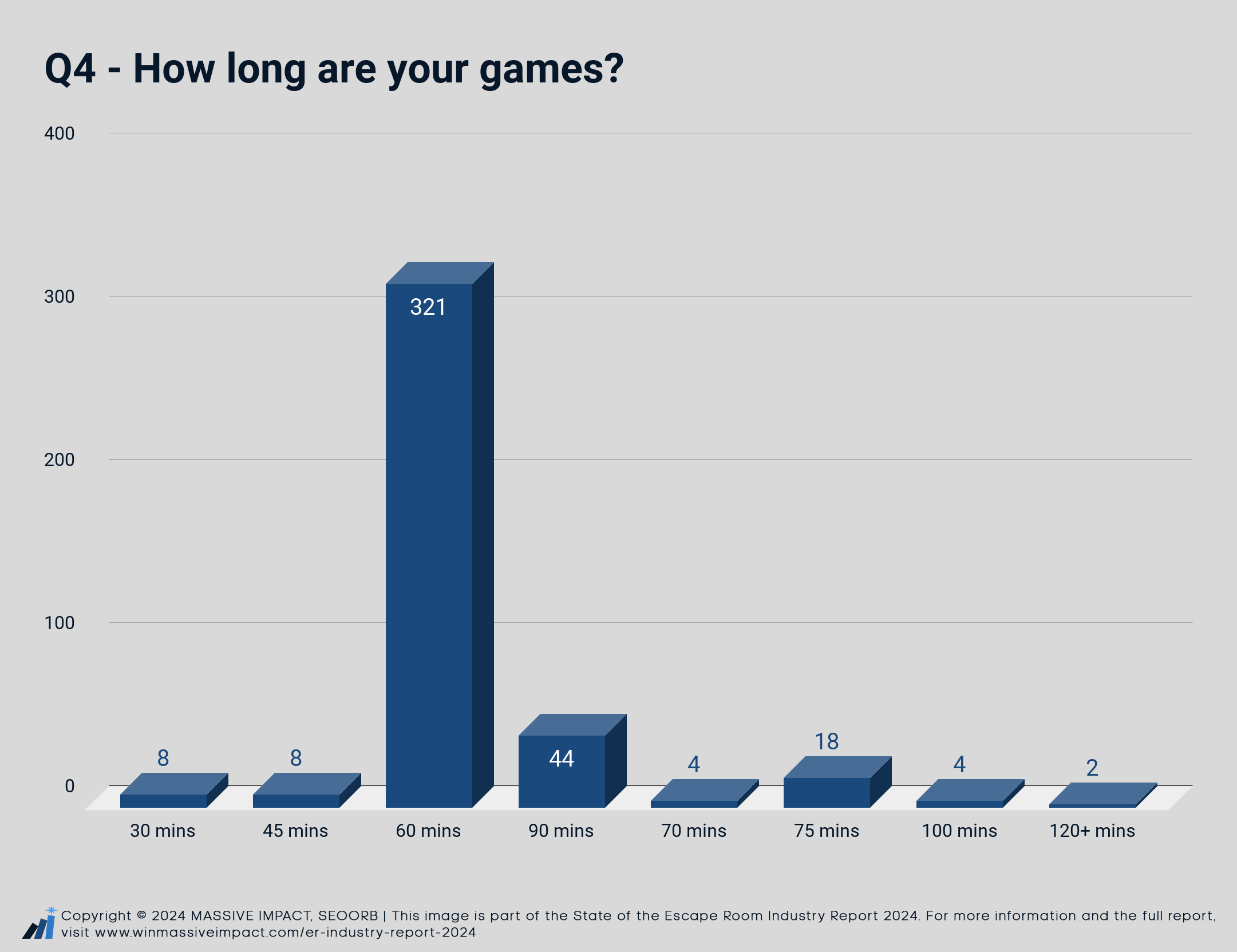

Q4 – How long are your games?

Multiple-Choice Question with an Open-Ended Option.

Participants: 364

Overview of Game Lengths

It’s not a surprise that 60-minute games as the most prevalent choice, followed by 90-minute challenges.

Note: As one escape room can offer games of different lengths, the percentage responses add up to more than hundred here:

- 60-minute games are overwhelmingly dominant, with 321 out of 364 respondents (88.2%) offering this duration.

- 90-minute games are the second most common, offered by 44 respondents (12.1%).

- 75-minute games are offered by 18 respondents (4.9%).

- Shorter games (30 and 45 minutes) and longer games (100+ minutes) are relatively rare, each offered by less than 5% of respondents.

Key Observations & Implications

- Multiple Time Format Offerings: 43 out of 364 businesses (11.8%) offer more than one time format for their escape room games

- Industry Standard: The 60-minute format appears to be the industry standard, likely due to its balance of challenge and time commitment.

- Extended Experiences: There’s a notable minority offering longer experiences (90 and 75 minutes).

- Niche Offerings: Very short (30-45 minutes) and very long (100+ minutes) games are niche products, potentially serving specific markets or use cases.

- Market Expectations: The prevalence of 60-minute games suggests this is what most customers expect, making it a safe choice for new businesses.

- Differentiation Opportunity: Offering non-standard game lengths could be a way for businesses to differentiate themselves in competitive markets.

- Pricing Considerations: Businesses offering longer games may have the opportunity to charge premium prices, potentially offsetting lower turnover rates.

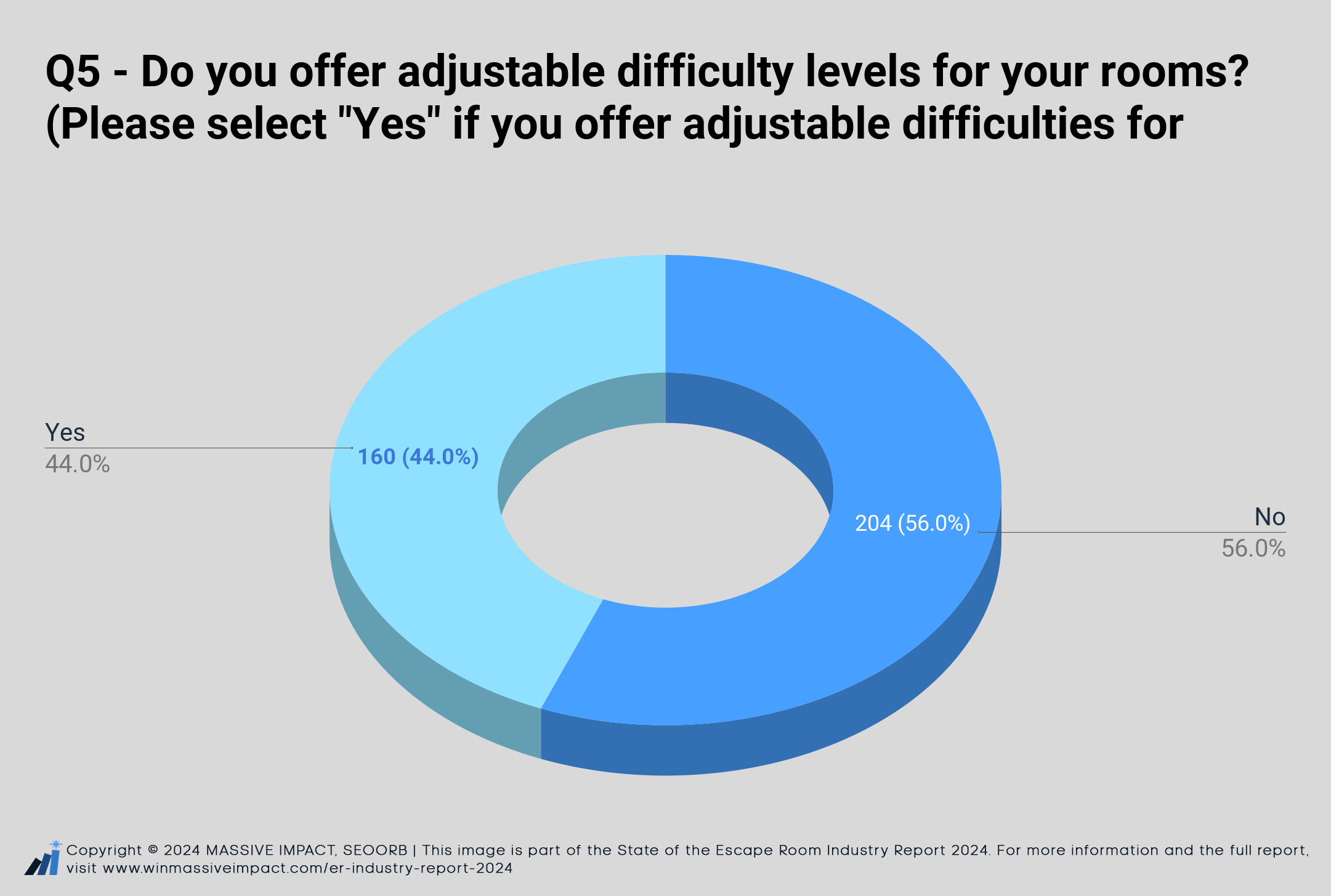

Q5 – Do you offer adjustable difficulty levels for your rooms? (Please select “Yes” if you offer adjustable difficulties for even one room)

Single-Choice Question.

Participants: 364

According to the survey, 44% of respondents offer adjustable difficulty levels in at least one of their rooms, while 56% do not. This could suggest adjustable difficulty levels are in demand, and this demand could keep growing.

The decision to offer adjustable difficulty likely depends on factors such as target audience, game design complexity, and operational preferences. It remains a consideration for businesses looking to customize their experiences based on customer demand or specific market conditions.

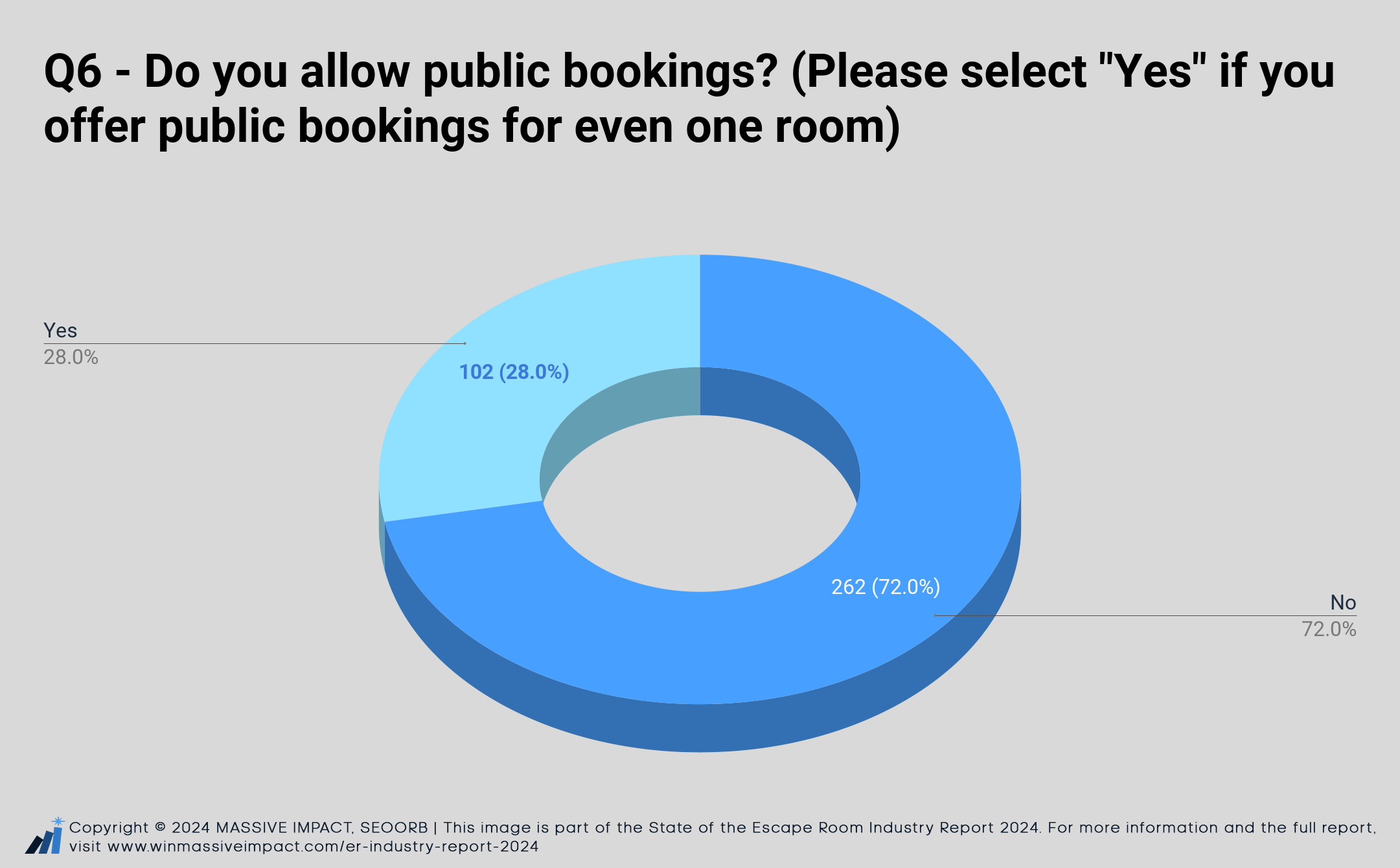

Q6 – Do you allow public bookings? (Please select “Yes” if you offer public bookings for even one room)

Single-Choice Question.

Participants: 364

The survey shows that 28% of escape room businesses allow public bookings, while 72% do not. This indicates a strong preference for private bookings in the industry, where groups have exclusive use of the room.

While not captured in the survey, it is generally known that many businesses offering public bookings also provide options for customers to upgrade to private bookings for an additional fee or with a set minimum number of players. This practice can vary depending on the business, allowing more flexibility in how customers experience the game.

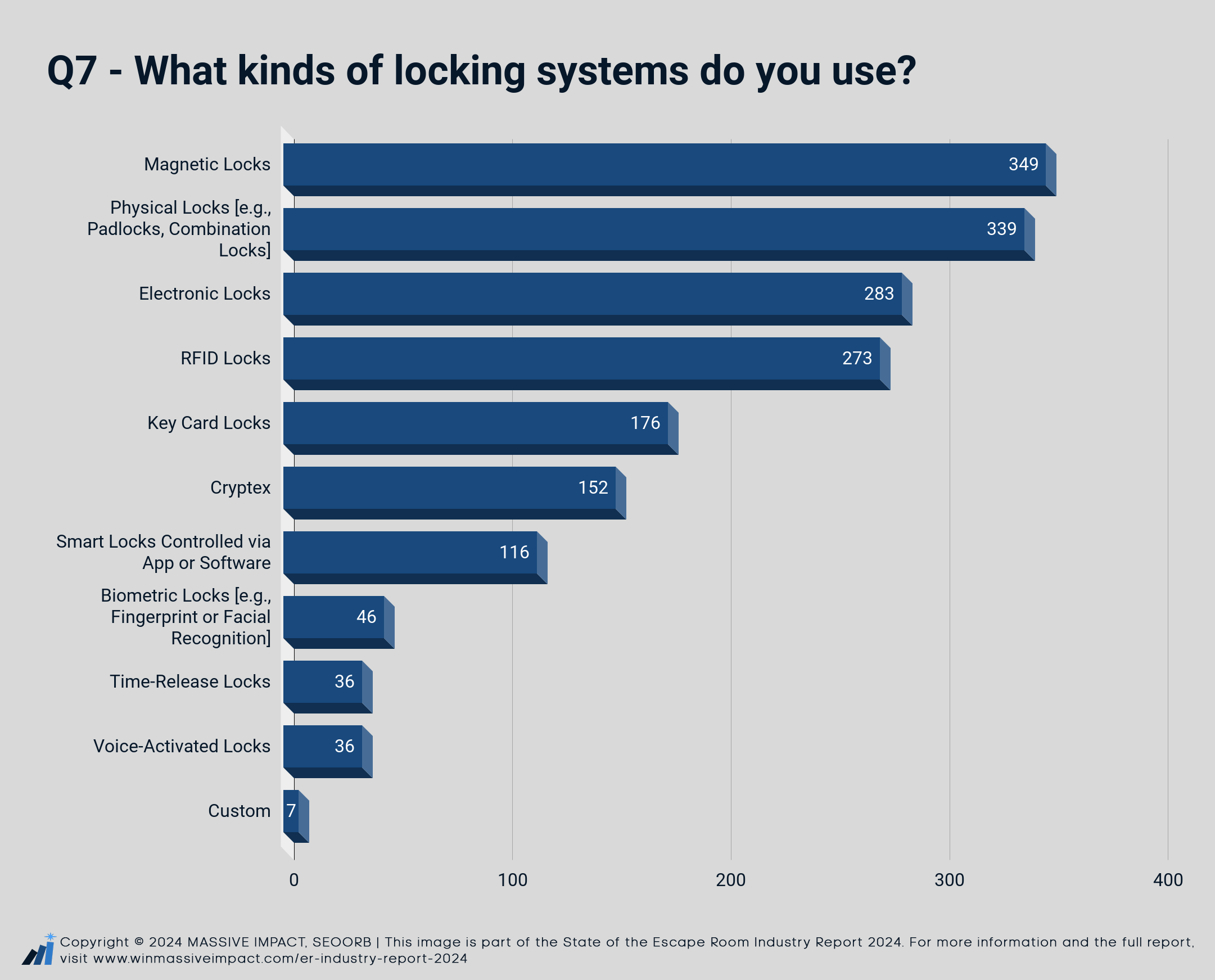

Q7 – What kinds of locking systems do you use?

Multiple-Choice Question with an Open-Ended Option.

Participants: 364

The survey results show that magnetic locks are the most widely used locking system in escape rooms, with 95.9% of businesses incorporating them. Physical locks, such as padlocks and combination locks, are also highly popular, used by 93.1% of respondents.

Other commonly used systems include electronic locks (77.7%) and RFID locks (75%), reflecting the increasing integration of technology in escape room designs. Key card locks are employed by 48.4% of businesses, while more advanced systems like smart locks (controlled via apps or software) are used by 31.9% of respondents.

Less frequently used options include cryptex locks (41.8%), biometric locks (12.6%), and voice-activated locks (9.9%).

According to the data, most escape room businesses utilize a combination of 5 to 7 different lock types, with 36.7% of businesses falling into this range. A small percentage (1.6%) of businesses use the maximum of 10 lock types that were asked in the survey, while 2.4% use only 1 lock type, indicating that there is a clear industry preference for diversity in locking mechanisms.

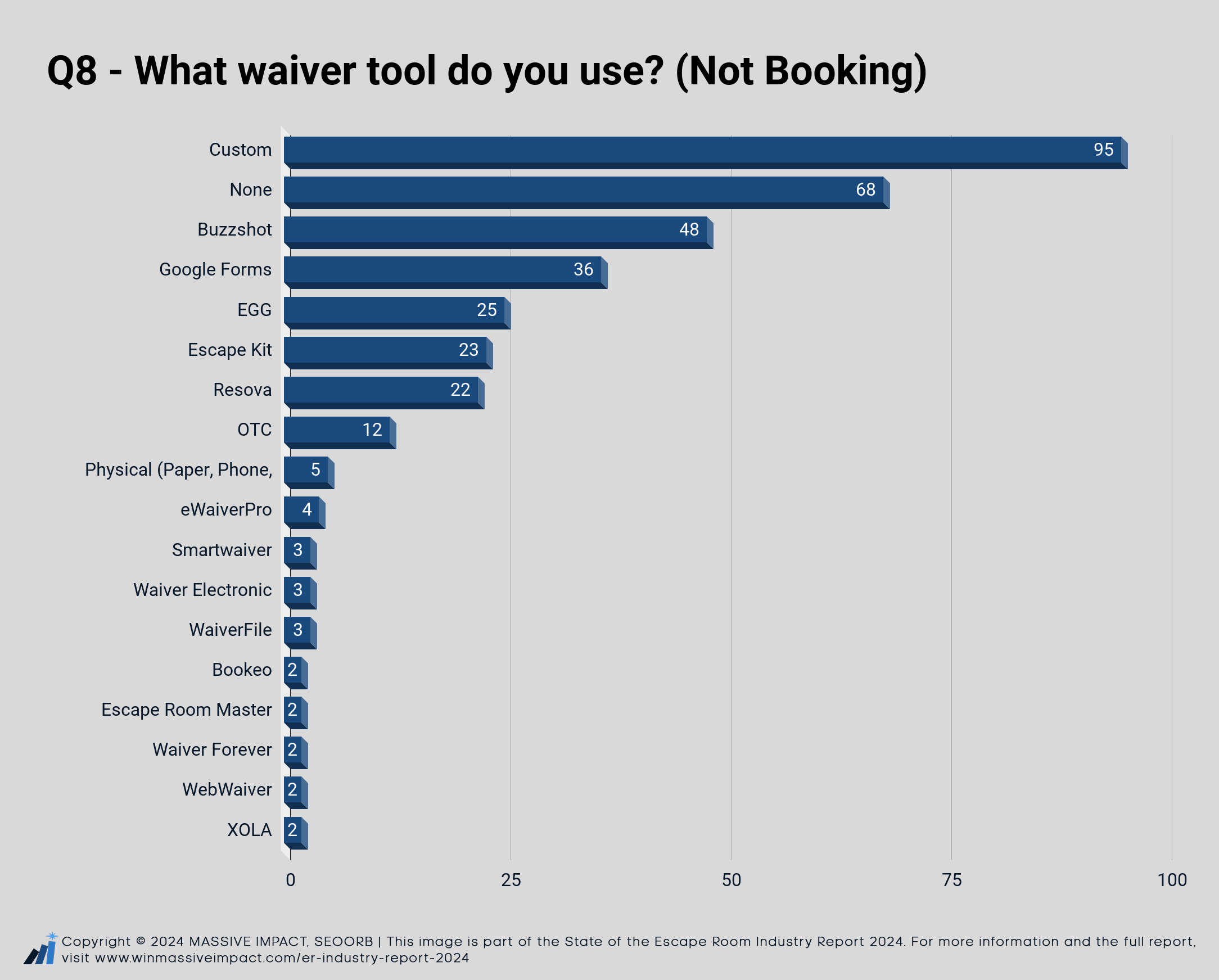

Q8 – What waiver tool do you use? (Not Booking)

Multiple-Choice Question with an Open-Ended Option.

Participants: 364

From the 364 respondents surveyed for Question 8, insights into the waiver tools used by escape room businesses reveal diverse approaches to waiver management. Custom solutions are the most popular, with 26.1% of respondents (95 businesses) opting for this option. Buzzshot is the second most commonly used tool, implemented by 13.2% of businesses (48 respondents), while Google Forms is utilized by 9.9% (36 respondents).

Interestingly, 18.7% of businesses (68 respondents) reported not using any waiver tool. It’s also worth noting that a small percentage of respondents indicated they are not legally required to use waivers. However, this percentage couldn’t be accurately calculated, as it overlaps with those who stated they do not use any waiver system.

This data suggests a broad range of approaches to waiver management, with many businesses either customizing their own solutions or using accessible options like Google Forms. The significant number of businesses not utilizing any waiver system reflects a potential gap in risk management practices within the industry, especially in regions where waivers may not be legally required.

Other mentions for waiver tools that could not be bucketed:

- Fareharbor

- Wherewolf

- Booked WordPress

- Google Calendar

- 4escape

- Tor4u

- Leisureking

- Vcita

- YouCanBookMe

- Peekpro

- Resmark

- SWaiver

- Booking Phoenix

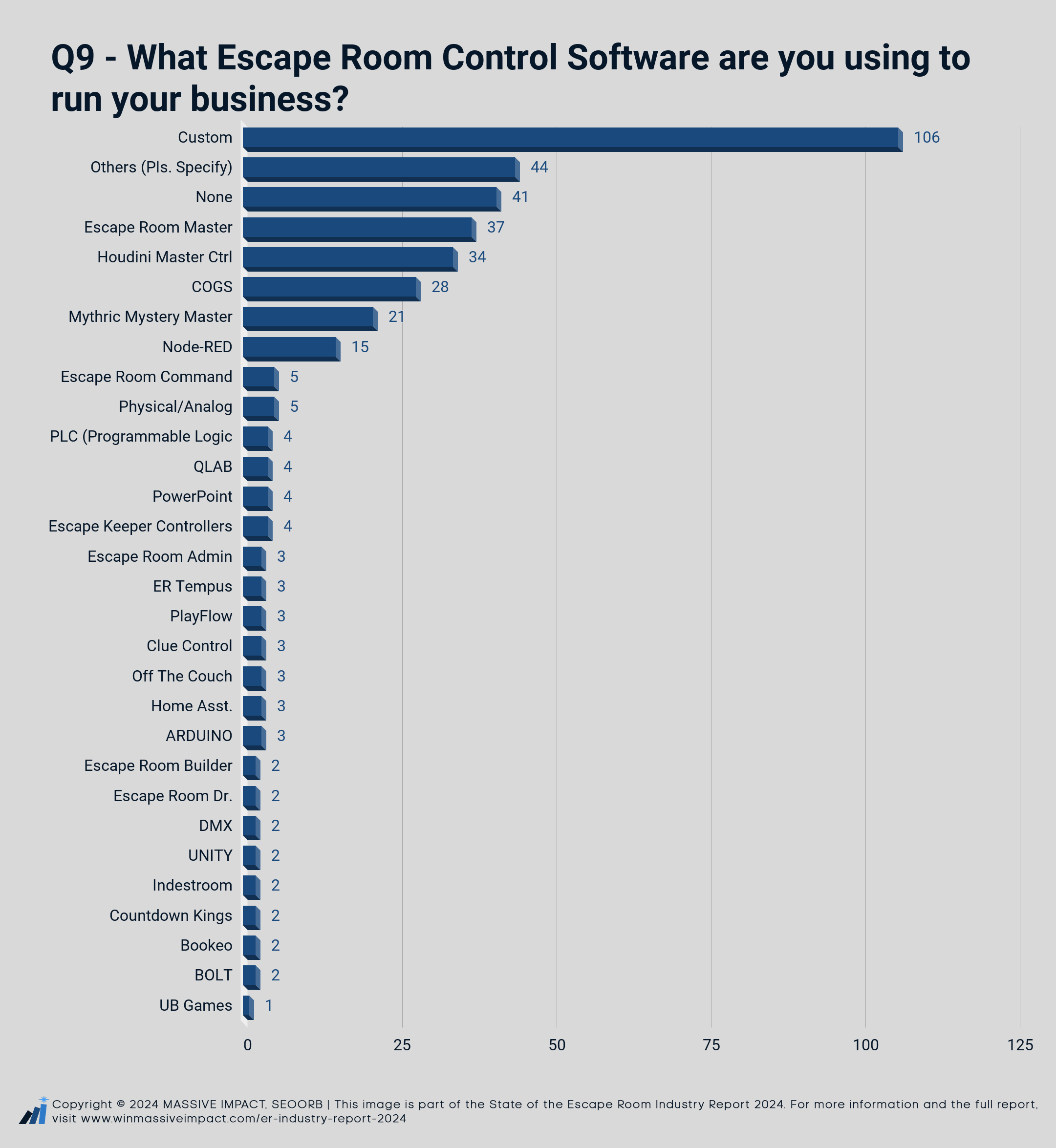

Q9 – What Escape Room Control Software are you using to run your business?

Multiple-Choice Question with an Open-Ended Option.

Participants: 364

A Small Note For The Graph Above: It is Escape Room Command Center, and not Escape Room Command.

The response for escape room control software shows a diverse mix of options. 29.1% of businesses use a custom solution, making it the most popular choice. Escape Room Master follows with 10.2%, and Houdini Master Control is used by 9.3% of respondents. COGS is chosen by 7.7%, while Mythric Mystery Master (M3) is utilized by 5.8%. Interestingly, 11.3% of businesses do not use any escape room control software.

Some other mentions for control software that couldn’t be bucketed:

- Escape room timer

- Ableton

- Lock and Code

- Tripworks

- Custom node.js

- Play Room

- ACE (Adventure Control Engine)

- 4escape

- Queen

- Legendary Quest

- Venuemagic

- APUZ

- Escape Director

- Mysterious Studio

- Quest Builder

- Vcita

- DMSS

- Gamer by kenttec.co.uk

- Lazy Giraffe

- Escape Room Supplier

- Escape Logic

- Time Quest Lab

- Max 8

- Acuity for bookings

- Digital IT

- Touch Designer

- Automated Puzzles

- Booking Phoenix

- Go Smart

- Clueby (proprietary software Puzzol Creative)

- Home Center 2

- EscapeLab (Dutch)

- Timer App

- Securetech system

- Software through PC phone

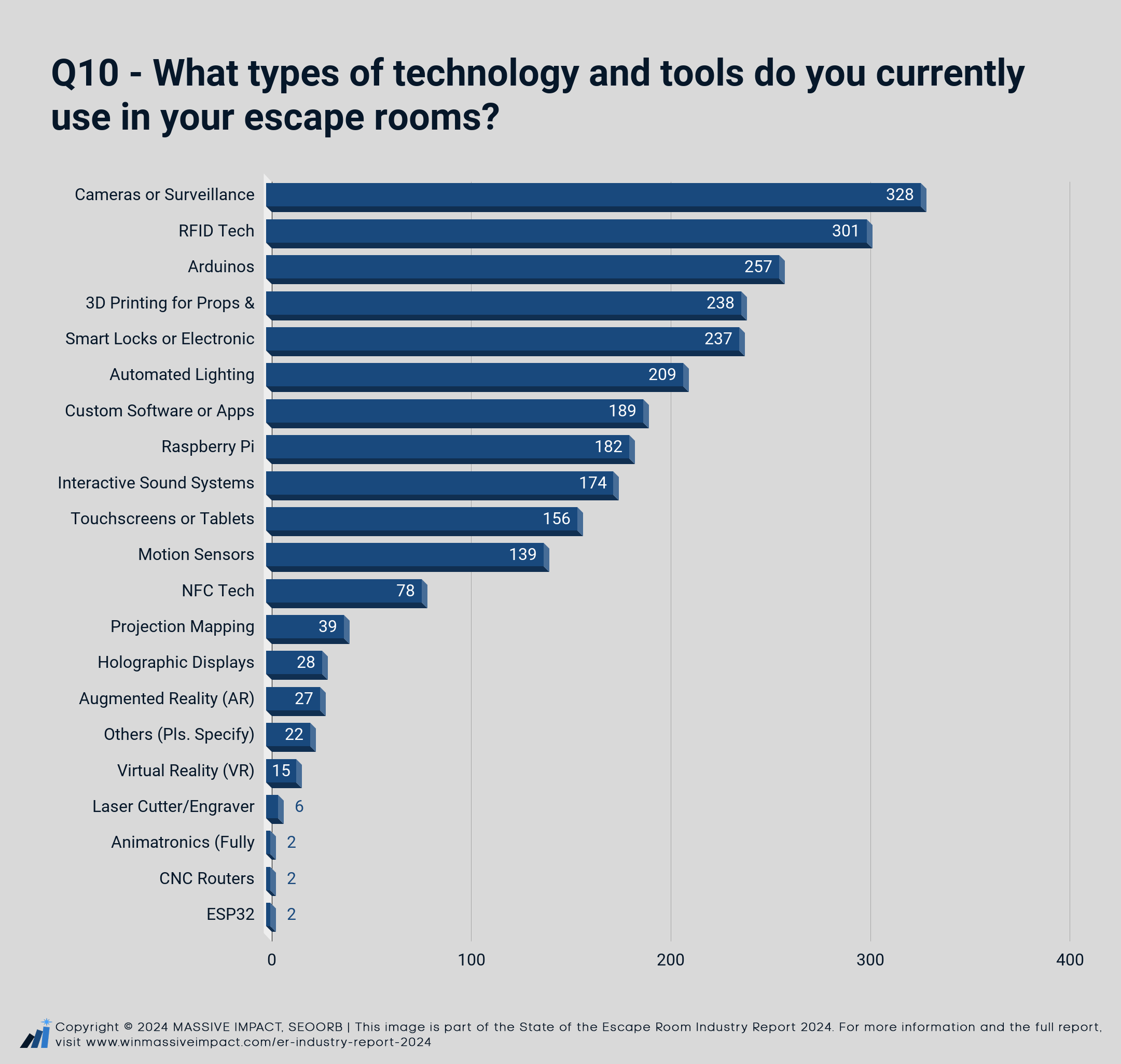

Q10 – What types of technology and tools do you currently use in your escape rooms?

Multiple-Choice Question with an Open-Ended Option.

Participants: 364

The survey shows that 90.1% of escape room businesses use cameras or surveillance systems, though 9.9% still operate without them. RFID technology is also common, with 82.7% adoption.

Technologies like Arduinos (70.6%), 3D printing (65.4%), and smart locks (65.1%) are widely used, offering a balance between cost and enhancing gameplay.

Emerging technologies, such as Augmented Reality (AR) (7.4%) and Virtual Reality (VR) (4.1%), have lower adoption which could be due to high costs and technical complexity but present significant opportunities for future growth.

While custom software is used by 51.9% of respondents, it often requires technical know-how or access to skilled professionals, making it a challenge for smaller operators without these resources.

- 23.5% of businesses (86 out of 364) use at least 9 of the 14 technologies listed in the survey. These businesses are more heavily invested in technology, likely using a wide range of tools to enhance gameplay and streamline operations.

- 19.8% of businesses (72 out of 364) use 7 to 8 technologies. This segment reflects a balanced approach, incorporating enough technology to enhance the player experience while maintaining operational simplicity.

- 24.6% of businesses (90 out of 364) use 5 to 6 technologies, which suggests a more moderate use of tools. These businesses may be focusing on essential technologies to meet core operational needs without adding complexity.

- 17.6% of businesses (64 out of 364) use 3 to 4 technologies, representing businesses that adopt a minimalist approach, focusing on key tools necessary for their operations.

- 5.8% of businesses (21 out of 364) use 1 to 2 technologies, suggesting that a small segment of businesses operates with very limited technological integration, likely relying on basic systems.

Other notable mentions of technology and tools that couldn’t be categorized but were mentioned once:

- Bad Ass Controllers

- Bottango

- Capacitative Sensors

- Cinematics

- Dolby atmos 3D sound

- Google Home – Ewelink

- IA voice generation

- Lazers

- Light Shows

- Linear Actuators

- Magnetic Contact Sensors

- Mechanical Puzzles

- Motion Control

- Motors

- Polarized Screens

- Programmable Logic Controlers

- QLab (DMX control of lights and sounds)

- Robots

- Short-throw Projectors

- Time Quest Lab Controllers

- TV, DVD, Casette, Tape Recorder

- Unity 3D Engine

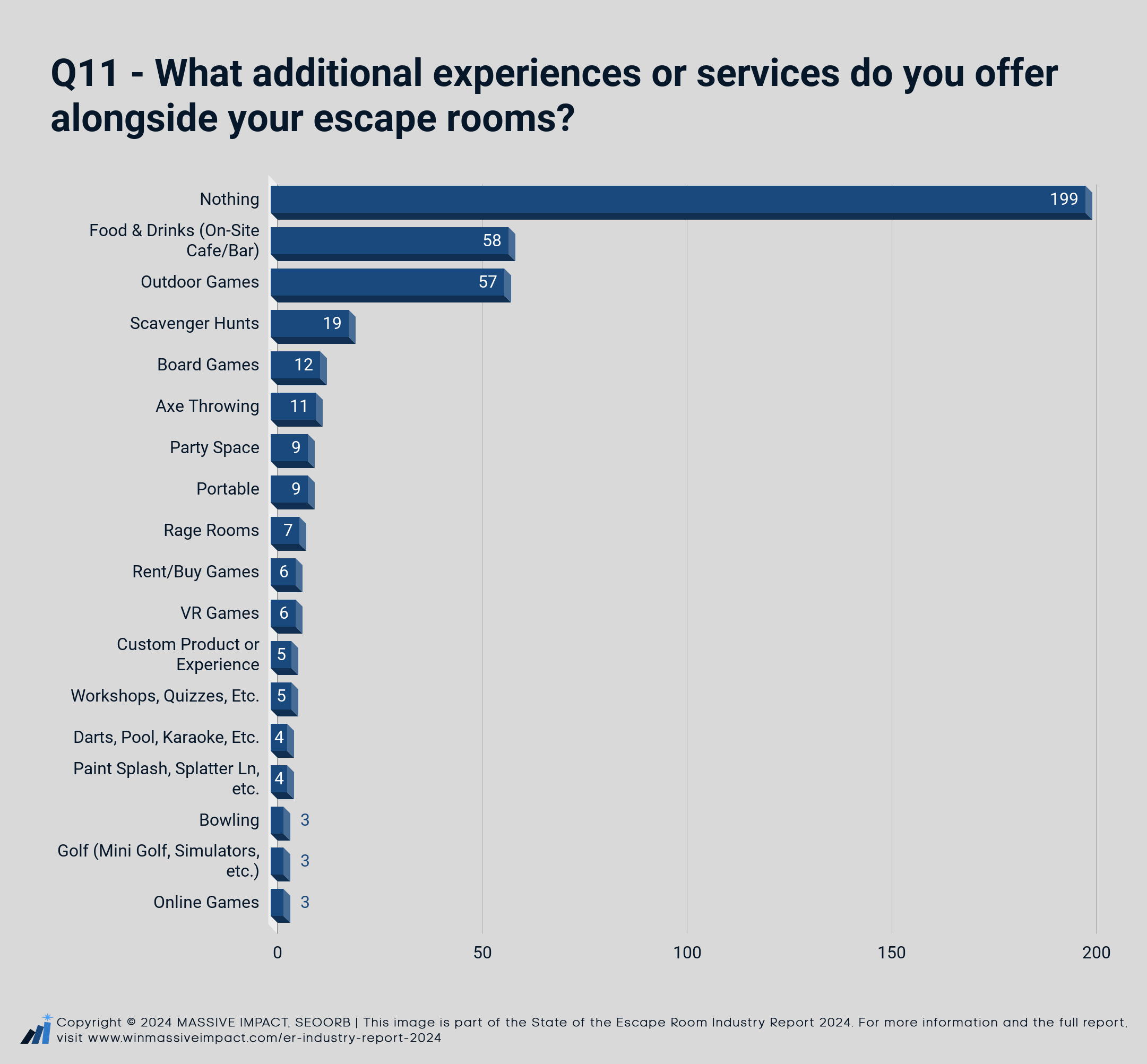

Q11 – What additional experiences or services do you offer alongside your escape rooms?

Multiple-Choice Question with an Open-Ended Option.

Participants: 364

The survey shows that 199 out of 364 respondents (54.7%) do not offer additional services beyond escape rooms. This may suggest that many businesses are focusing on maximizing their space for more escape room options. Alternatively, this could be due to limitations such as space, manpower, or other operational constraints.

Among those that do diversify, the most common offerings are food & drinks (15.9%) and outdoor games (15.7%).

Emerging trends include:

- Scavenger hunts (5.2%) and axe throwing (3%) reflect a shift toward interactive and physical activities.

- Rage rooms (1.9%) and VR games (1.6%) show a growing interest in newer immersive experiences.

This suggests that some operators are seeking to increase customer engagement and revenue through complementary activities.

- 2.5% of businesses (9 out of 364) offer 3 or more additional experiences alongside their escape rooms. These operators are heavily invested in diversifying their offerings to enhance customer engagement and revenue streams.

- 10.7% of businesses (39 out of 364) provide 2 additional experiences, reflecting a moderate level of diversification that may focus on popular add-ons like food services or outdoor games.

- 24.2% of businesses (88 out of 364) offer 1 additional experience, suggesting that many operators are experimenting with extending their services beyond just escape rooms, but with a focused approach.

- A significant 62.6% of businesses (228 out of 364) do not offer any additional experiences, indicating that the majority of escape room operators remain focused solely on their core escape room offerings. This could be due to space limitations, operational focus, or a strategic decision to maximize the number of escape rooms within their venues.

This list of unique experiences was mentioned once and could not be categorized into other existing groups:

- Cube Game from Game Over Escape Room

- Mobile Nerf Battle

- Interactive Murder Mystery

- Cocktail Workshop

- Blackjack Workshop

- Pixel Arena

- Kids Play Space

- Drift Karting

- Nox Room

- Pixel Floor

- Costumes

- Maze

- Drinks & Games in a Themed Bar

- Ghost Hunt

- Yearly Cosplay Event

- Arena Competition Software

- Immersive Magic Show

- Bus Escape Games (Portable Games)

- Hot Seats – 5 minute lobby games

- Room Rental (example: Game Show Live Fayetteville Room Rental)

- Immersive Theater & Dinner

- Weekend Mission

- Laser Tag

- Field Trips

- Hot Tub and Kayaks

- Prop Rentals

- 3D Printed Fun Stuff

- Local Art

- Events at Fairs

- One-off Amazing Race Event

- Large-Scale Portable Game

- Arcade

- Escape Room Design Teaching for Kids

- Local Business Partnerships

- Sip & Paint Experience

- Dungeons & Dragons

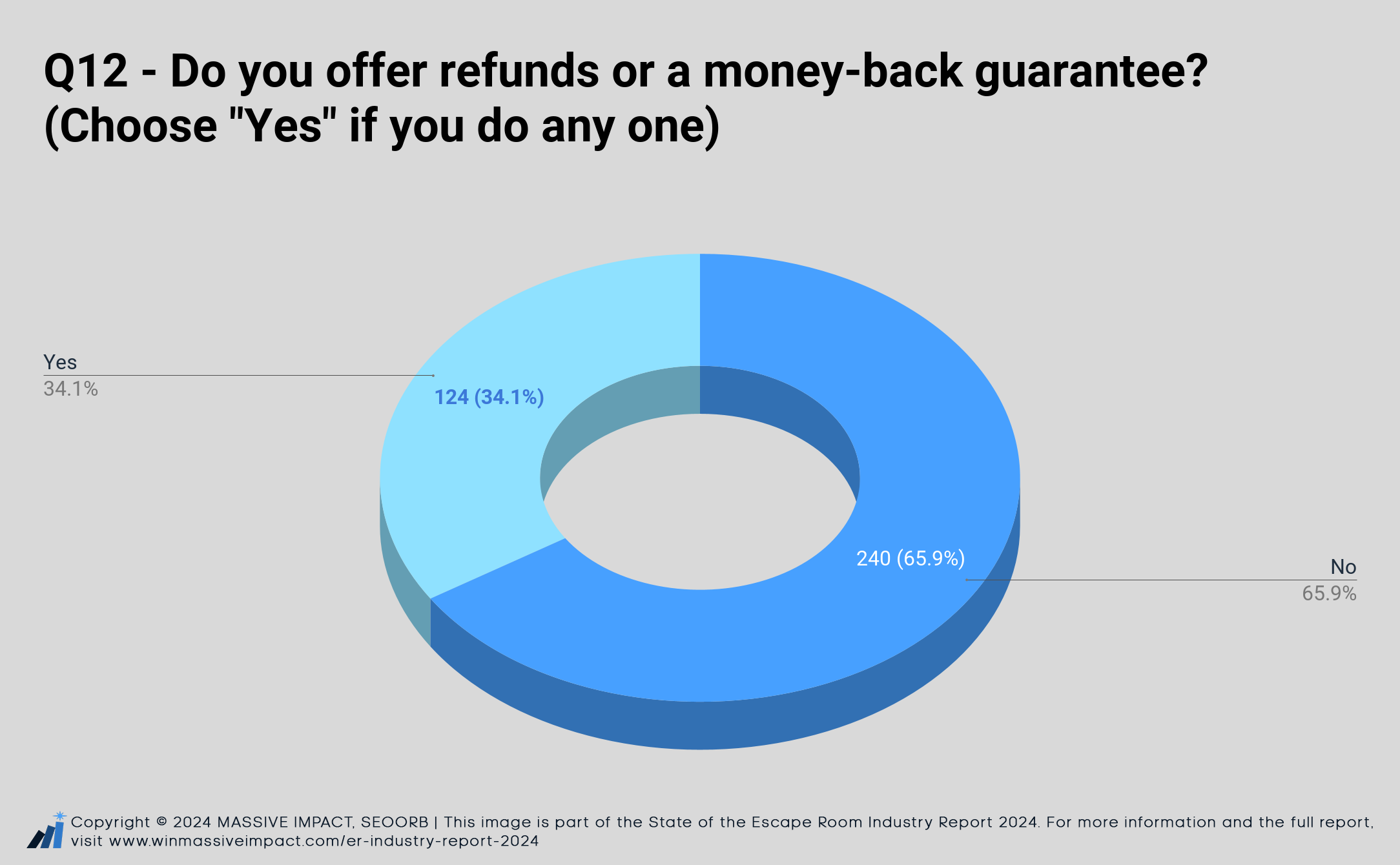

Q12 – Do you offer refunds or a money-back guarantee? (Choose “Yes” if you do any one)

Single-Choice Question.

Participants: 364

Approximately one-third of businesses (34.1%) offer a money-back guarantee or refunds, while 65.9% choose not to provide these options.

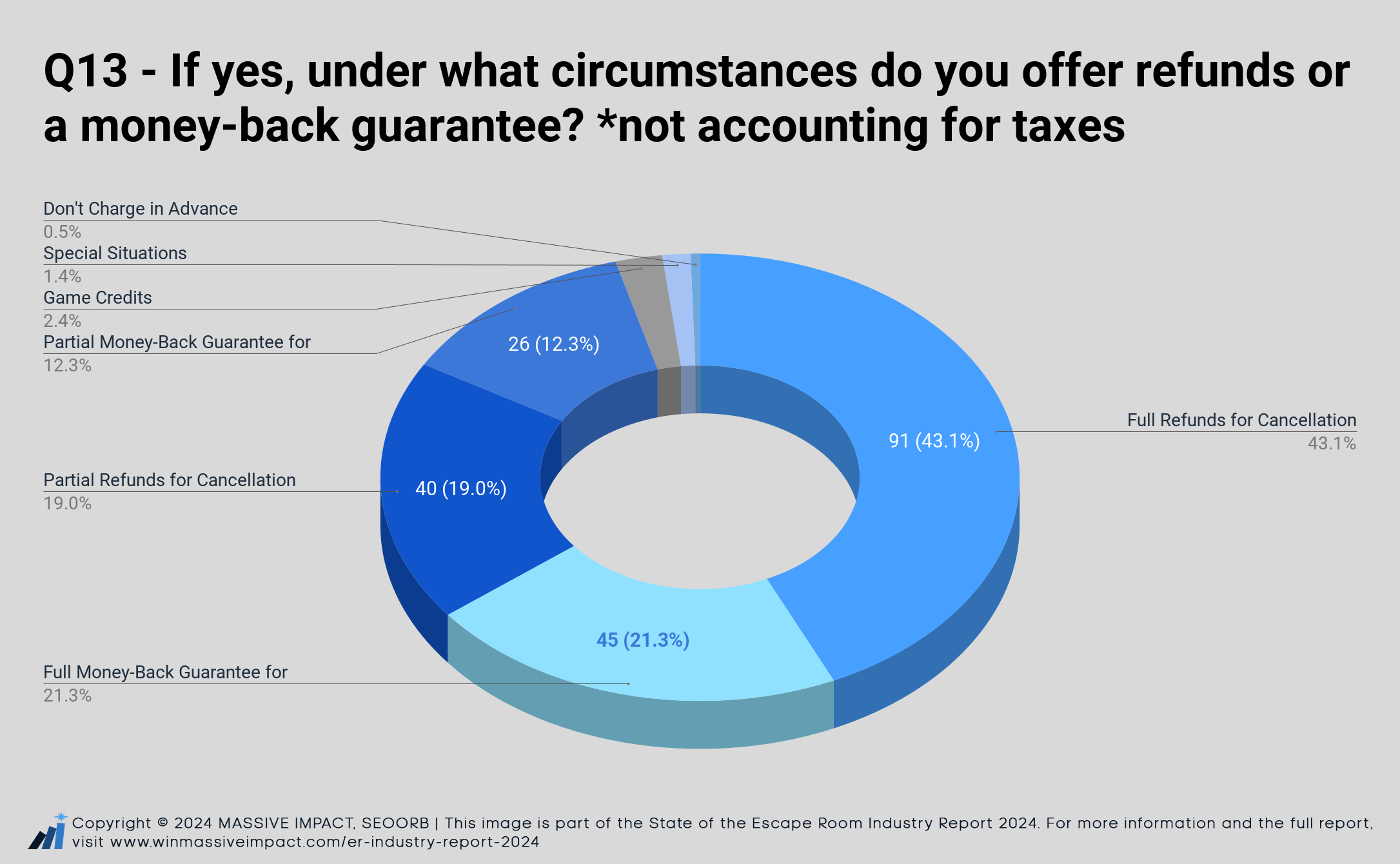

Q13 – If yes, under what circumstances do you offer refunds or a money-back guarantee? not accounting for taxes

Multiple-Choice Question with an Open-Ended Option.

Participants: 124

The survey results show a variety of reasons for offering refunds or money-back guarantees among the 124 businesses that provide these options:

- 73.4% of businesses offer full refunds for cancellations (91 respondents).

- 36.3% provide a full money-back guarantee for unsatisfactory experiences (45 respondents).

- 32.3% offer partial refunds for cancellations (40 respondents).

- 21% provide a partial money-back guarantee for unsatisfactory experiences (26 respondents).

- 4% offer game credits as an alternative to refunds (5 respondents). This policy was mentioned in open-ended responses and was not listed as an option in the survey. Therefore, it could be more common than the results show.

These findings suggest that most businesses offering refunds are primarily focused on cancellations, while a smaller percentage provides refunds for unsatisfactory experiences. Options like partial refunds and game credits offer additional flexibility, though they are less commonly used.

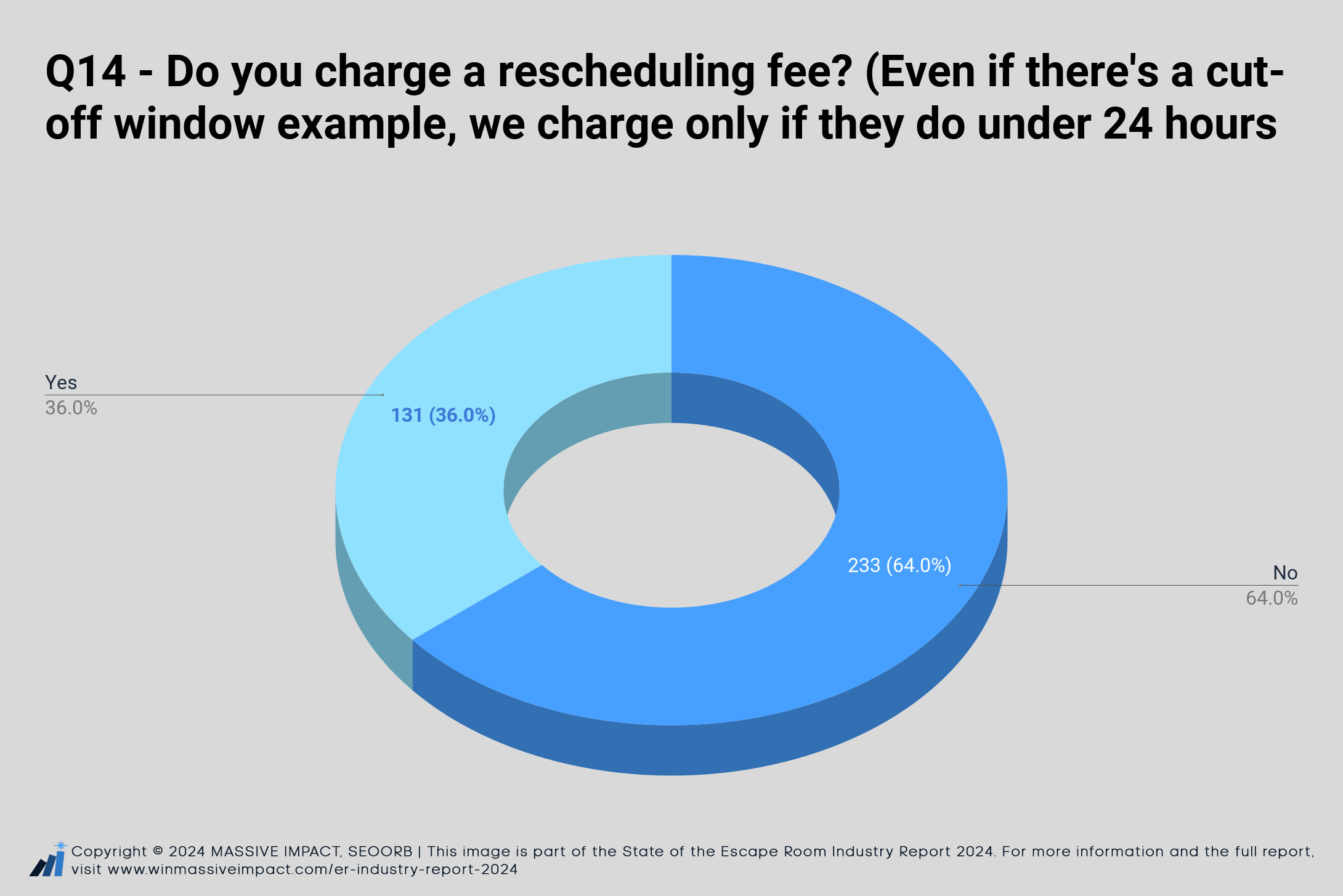

Q14 – Do you charge a rescheduling fee? (Even if there’s a cut-off window example, we charge only if they do under 24 hours etc).

Single-Choice Question.

Participants: 364

The survey results show that the majority of escape room businesses do not charge a rescheduling fee:

- 64% of businesses (233 out of 364) do not charge a rescheduling fee, even if a cut-off window applies.

- 36% of businesses (131 out of 364) do charge a rescheduling fee, typically if the reschedule request occurs within a certain time frame (e.g., within 24 hours before the booking).

These findings suggest that while many businesses offer flexibility in rescheduling, a significant portion still implements fees, likely to manage last-minute changes and protect revenue.

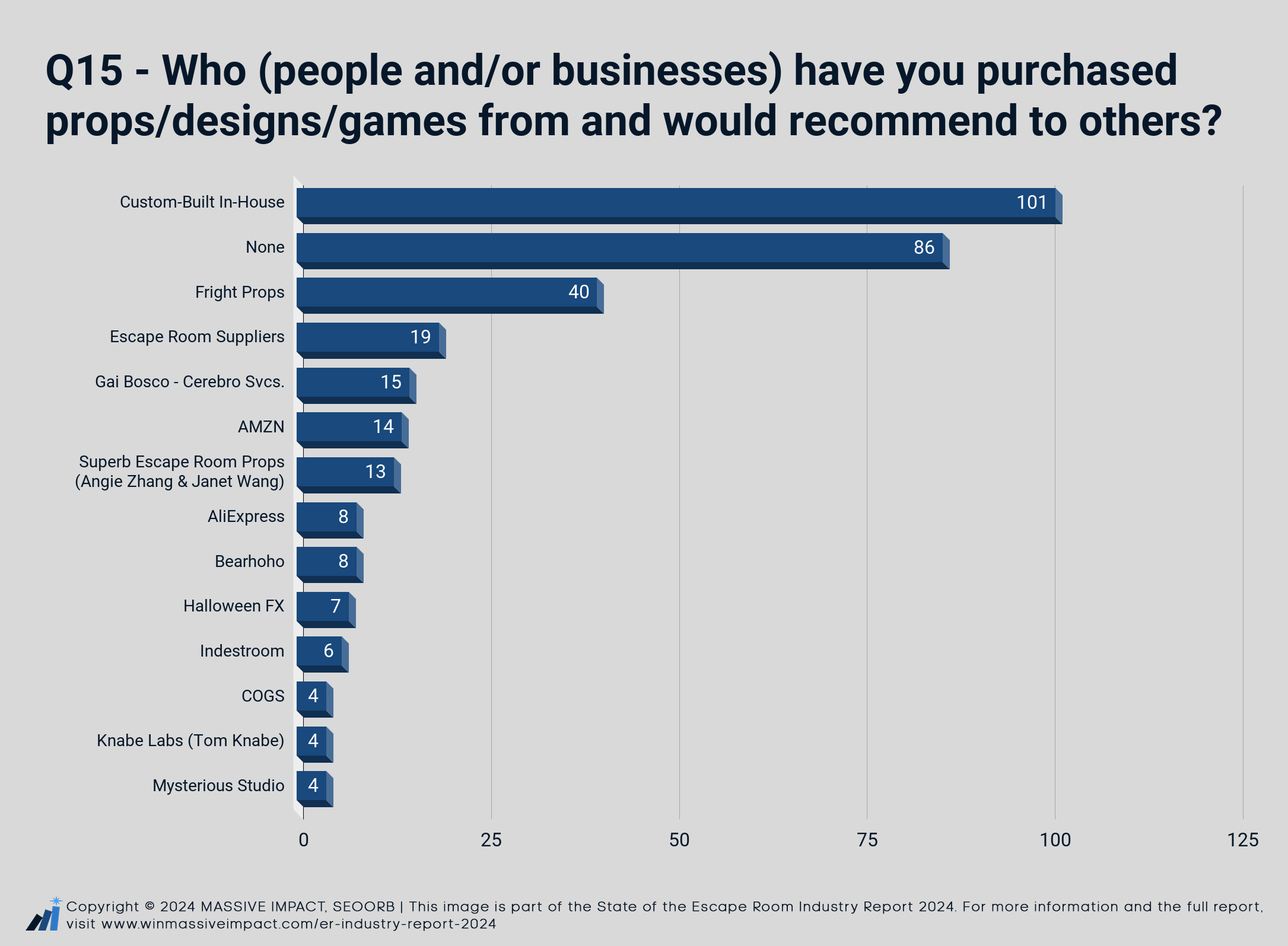

Q15 – Who (people and/or businesses) have you purchased props/designs/games from and would recommend to others?

Open-Ended Question.

Participants: 364

The survey reveals a diverse range of sources escape room businesses use for purchasing and recommending props, designs, and games:

- Custom-built in-house solutions are the most popular choice, with 101 respondents preferring to create their own props and designs. This reflects a strong preference for customization and control over game elements.

- Fright Props is the most frequently recommended external supplier, with 40 respondents highlighting its offerings for quality and variety.

- Escape Room Supplier was cited by 19 respondents, and Amazon by 14 respondents as reliable sources for props and materials.

- Gai Bosco – Cerebro Services was mentioned by 15 respondents, receiving notable praise, particularly from Israeli companies, for exceptional game design and scripting skills.

- Superb Escape Room Props was also recommended by 12 respondents.

Additional open-ended responses mentioned:

- Bearhoho, HalloweenFX, and Knabe Labs, which were recognized by a small number of businesses for their props and services.

- Tony Campagna for realistic, Hollywood-quality body props.

- Etsy sellers for unique and artistic pieces.

- Escape Solutions, recognized for hardware and puzzle solutions.

These findings suggest that while many businesses favor in-house production, external suppliers like Fright Props, Gai Bosco, and Superb Escape Room Props are trusted sources. Furthermore, smaller, specialized vendors like Tony Campagna and Escape Solutions are valued for niche offerings.

Other providers that were mentioned at least once:

- 2 Artists

- Anidea Engineering

- Antique Shops

- Arena Competition

- Art-FX Studios

- Austin Reed

- Automated Puzzles

- Bad Ass Controllers

- Ben Andrews

- Bespoke Escape Room Padlocks

- Brainy Labs

- Brett Kueher

- Brian Warner

- Buzzshot

- Chelios Props

- Chris Bell Prop Design

- Chris Williamson

- Clue Control

- ClueQuest – 3D Printing

- Codex Bucharest

- Commissioned art pieces from Local Artists

- Creative Craft House

- Creative Works

- Crux Scenica in Richmond VA

- Dark Tech Effects

- Eastern Voltage

- eBay

- Echo-ID

- Eli Gazit (Software)

- Escape Empire

- Escape Room Doctor

- Escape Room Factory

- Escape Room International

- Escape Solutions

- Escape Workshop

- EscapeLAB

- Escapely

- Escaperoom Techs

- Eurekatec

- Evan and Judy Fort

- Fossil Forge

- Frightideas.com

- Game Crafts

- Gamemasters Escape Solutions in Winnipeg

- Green Lama

- Guy Moshe

- HAA Show Trade Show

- HauntSupply.com

- Home Depot

- Horror Dome

- https://props.nl/https://www.facebook.com/izobretilnitsa/

- IAAPA Trade Show

- Ilya Vett

- Immersive Tech

- Independent on Etsy

- Ingeniero 3D

- Junk or Thrift Stores

- Kenttec.co.uk

- Keytown Kaiserslautern

- Kryptex

- Labsterium

- Laser Cutting Pro – Andover

- Legendary Escape Games

- Legendary Quests

- Local 3D Printer (Craftspeople)

- Marisa from Expedition Escapes

- Martin Raysnsford

- Master Locks

- Matoki (Design, Build)

- McCord Technologies

- Mindgames

- Morbid Escape Rooms

- Muddy Water Metal Art

- NCV Creative

- Other escape rooms

- Playful Technology

- Puzzle Master

- Puzzol Creative

- RJ Haddy’s Rad FX Co

- Scapecraft in the Netherlands

- Scapegoat

- Scenograph from Chambery

- Smithworks

- spelontwerp.be

- Studio Semaphore

- Supreme Props

- Susan Dooley (Artist)

- Svetoslav Tzenov

- Synthesis

- Tactical Escape 101

- Tempus

- The Goggin Group, LLC

- The Riddle Room

- TheClueRoom.com

- Themescape (Colorado, USA)

- Themescapes Creations

- Thrift Books

- Tony Campagna

- Tony Stani

- Trap

- Trapped.com

- Victor Creations

- Vistaprint

- Woodpeckers Crafts

- Zarztech from Phoenixville, PA

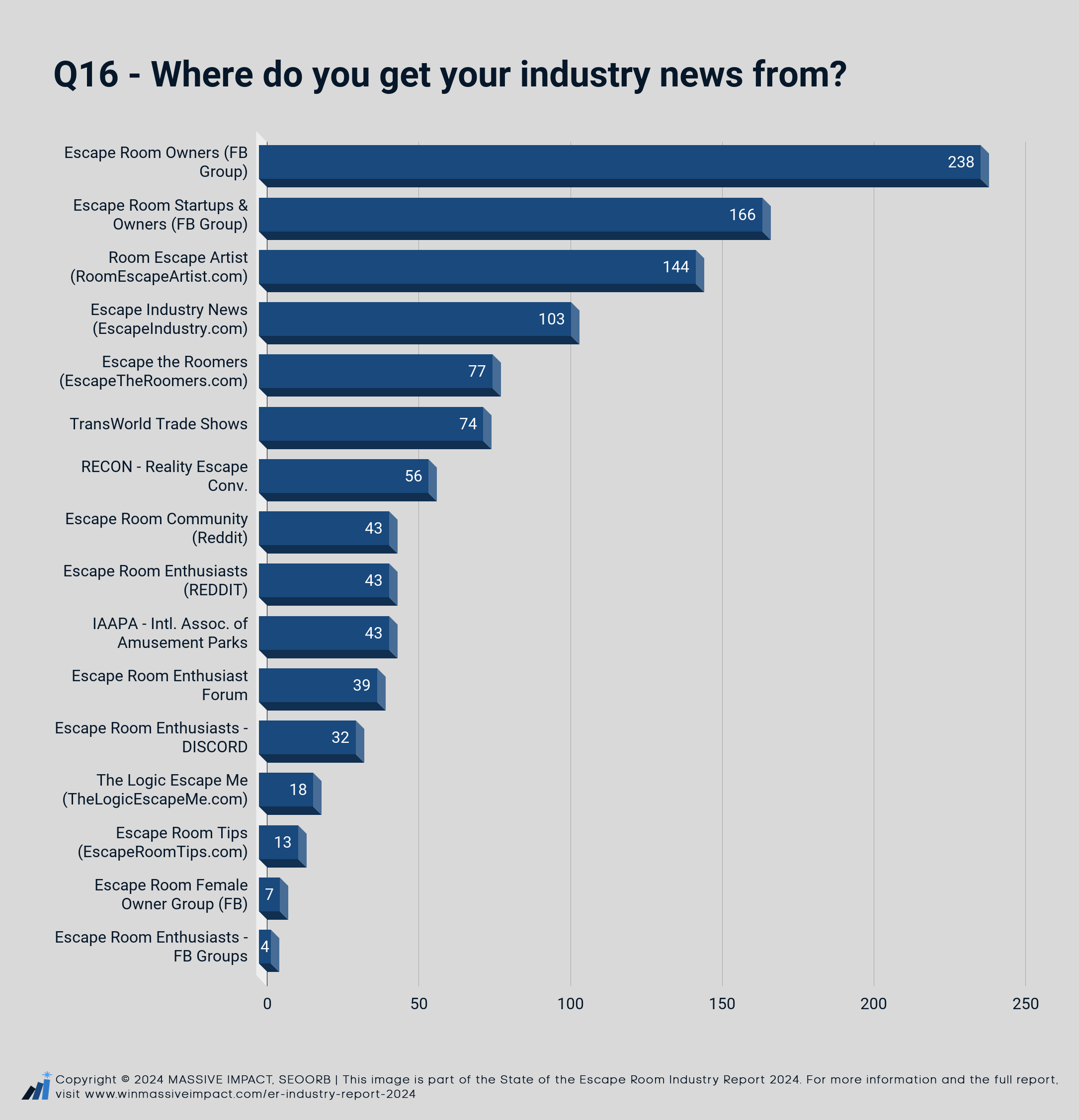

Q16 – Where do you get your industry news from?

Multiple-Choice Question with an Open-Ended Option.

Participants: 364

The survey results for Question 16 reveal that escape room businesses primarily rely on community-driven platforms and specialized websites for industry news:

- Facebook groups are the largest source of industry news, with the “Escape Room Owners” group (238 respondents) and the “Escape Room Startups and Owners” group (166 respondents) highlighting the significance of Facebook communities in the industry.

- Room Escape Artist (RoomEscapeArtist.com) is another widely used source, cited by 144 respondents. Beyond being the most popular dedicated industry website, they significantly contribute to the escape room industry through initiatives like RECON, REPOD, organizing tours, and other resources that support and engage the community.

- Escape Industry News (EscapeIndustry.com) is also a key resource, with 103 respondents relying on it for updates.

In addition to online communities and industry-specific websites, traditional industry sources like IAAPA (43 responses) and events such as RECON (56 responses) are still relevant, though they rank lower in popularity compared to Facebook groups and specialized blogs.

These findings suggest that escape room owners prefer engaging with interactive, community-driven platforms and specialized content, emphasizing the importance of both peer-to-peer discussions and expert coverage in staying updated with industry trends and news. The diversity of sources also points to a well-connected ecosystem where owners actively seek information through multiple channels.

While the survey results highlight popular community-driven platforms and specialized websites, there were several other notable mentions that appeared less frequently—most being referenced fewer than three times. These sources, though not as widely cited, reflect the diverse ways escape room owners stay informed:

- Podcasts: REPOD, Escape Break, Mystery Soup (3 mentions)

- BEFEB (Belgian Escape Room Federation) (2 mentions)

- Escape Room News Center (ERNC) (2 mentions)

- Escape The Review (2 mentions)

- EscapeGame.fr (2 mentions)

- Escaperoomers.de (2 mentions)

- EscapeTalk.NL (2 mentions)

- Morty App (2 mentions)

- Regional/Local Escape Room Owners/Enthusiasts (Australia) (2 mentions)

- Room Owners WhatsApp Groups (2 mentions)

- Escape Room Owners Australia

- Dutch WhatsApp group

- French discords and websites

- Central escapes

- https://www.facebook.com/groups/493838418258543 (Facebook group)

- Visitors (as a source of news)

- Guy Bosco

- Owners Day, an annual event at One Way Out, Oakham

- Just going out and playing games to see what is out there

- Prop trade shows (not escape room exclusive)

- Interactive experiences (ex: Meowulf)

- Immersive Experience Network

- Podcast in BE and NL – also colleagues

- Lockme

- LEAG – German-speaking association

- North Carolina/South Carolina Owners Group (Facebook)

- French platforms

- UpTheGame (past event)

- Terpeca (Top Escape Rooms Project Enthusiasts’ Choice)

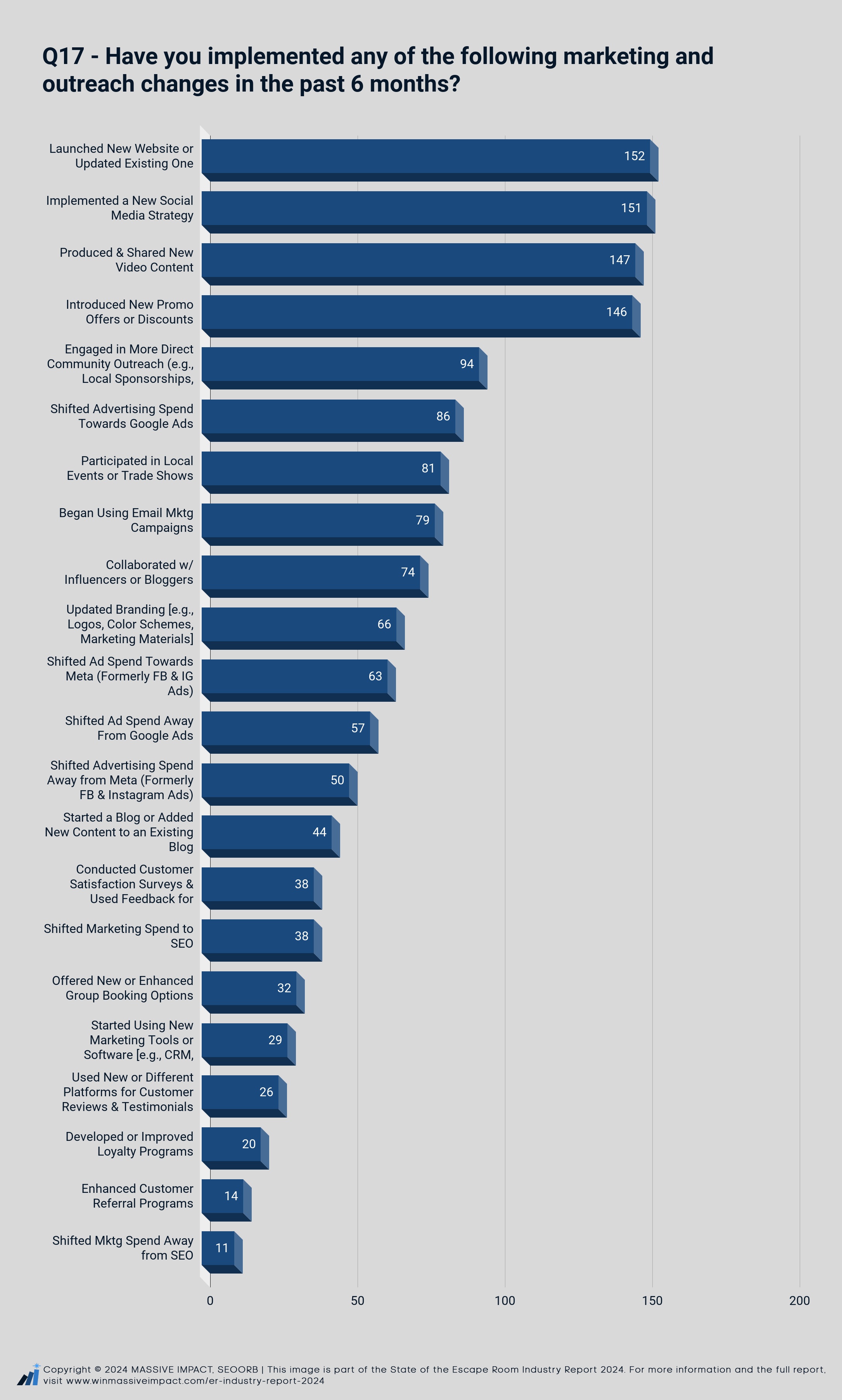

Q17 – Have you implemented any of the following marketing and outreach changes in the past 6 months?

Multiple-Choice Question.

Participants: 364

The survey results for Question 17 highlight the marketing and outreach strategies implemented by escape room businesses over the past six months. Key findings include a strong focus on digital presence and content creation:

- 41.8% of businesses (152 respondents) launched or updated a website, making it the most popular strategy.

- 41.5% (151 respondents) implemented new social media strategies.

- 40.4% (147 respondents) produced and shared new video content.

These top strategies underscore the industry’s emphasis on strengthening online visibility and engaging customers through digital platforms.

Other notable strategies include:

- 40.1% of businesses (146 respondents) introduced new promotional offers or discounts.

- 25.8% (94 respondents) engaged in more direct community outreach.

- 22.3% (81 respondents) reported participating in local events and trade shows.

- 23.6% of respondents (86) shifted their advertising spend towards Google Ads, while 17.3% (63 respondents) moved their ad spend towards Meta platforms (formerly Facebook and Instagram).

Less commonly implemented strategies include:

- 5.5% of businesses (20 respondents) developed or improved loyalty programs.

- 3.8% (14 respondents) enhanced customer referral programs.

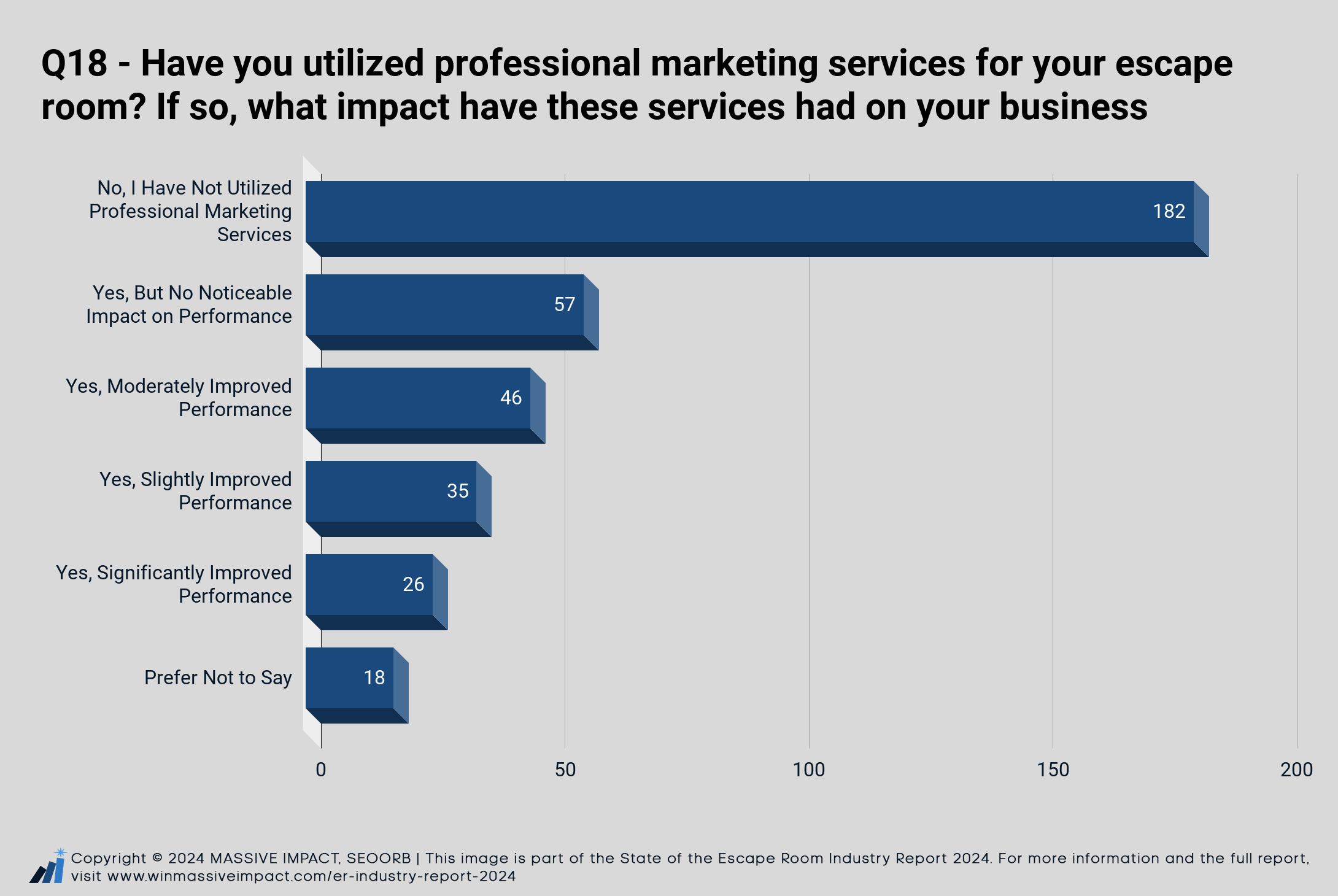

Q18 – Have you utilized professional marketing services for your escape room? If so, what impact have these services had on your business performance?

Multiple-Choice Question.

Participants: 364

50% of respondents (182 out of 364) have not utilized professional marketing services, suggesting that many escape room businesses rely on in-house efforts or other methods.

15.7% of respondents (57 businesses) used professional marketing services but reported no noticeable impact on performance. This may indicate potential dissatisfaction or poor experiences with the service providers they worked with.

On the positive side, 12.6% of respondents saw moderate improvement from professional marketing efforts, while 9.6% reported slight improvements. A smaller group, 7.1%, reported significant improvements, such as noticeable increases in bookings, engagement, and revenue.

PLEASE NOTE: It’s important to recognize that this question could have been better worded to offer more clarity on negative outcomes or poor performance. Including options like “Negative impact” or “Poor performance despite using professional services” would have provided a more comprehensive view of the experiences respondents had. For example, the question could have included:

- “Yes, but it negatively impacted performance.”

- “Yes, but the results were poor or not as expected.”

This adjustment could better capture the range of outcomes from using professional marketing services.

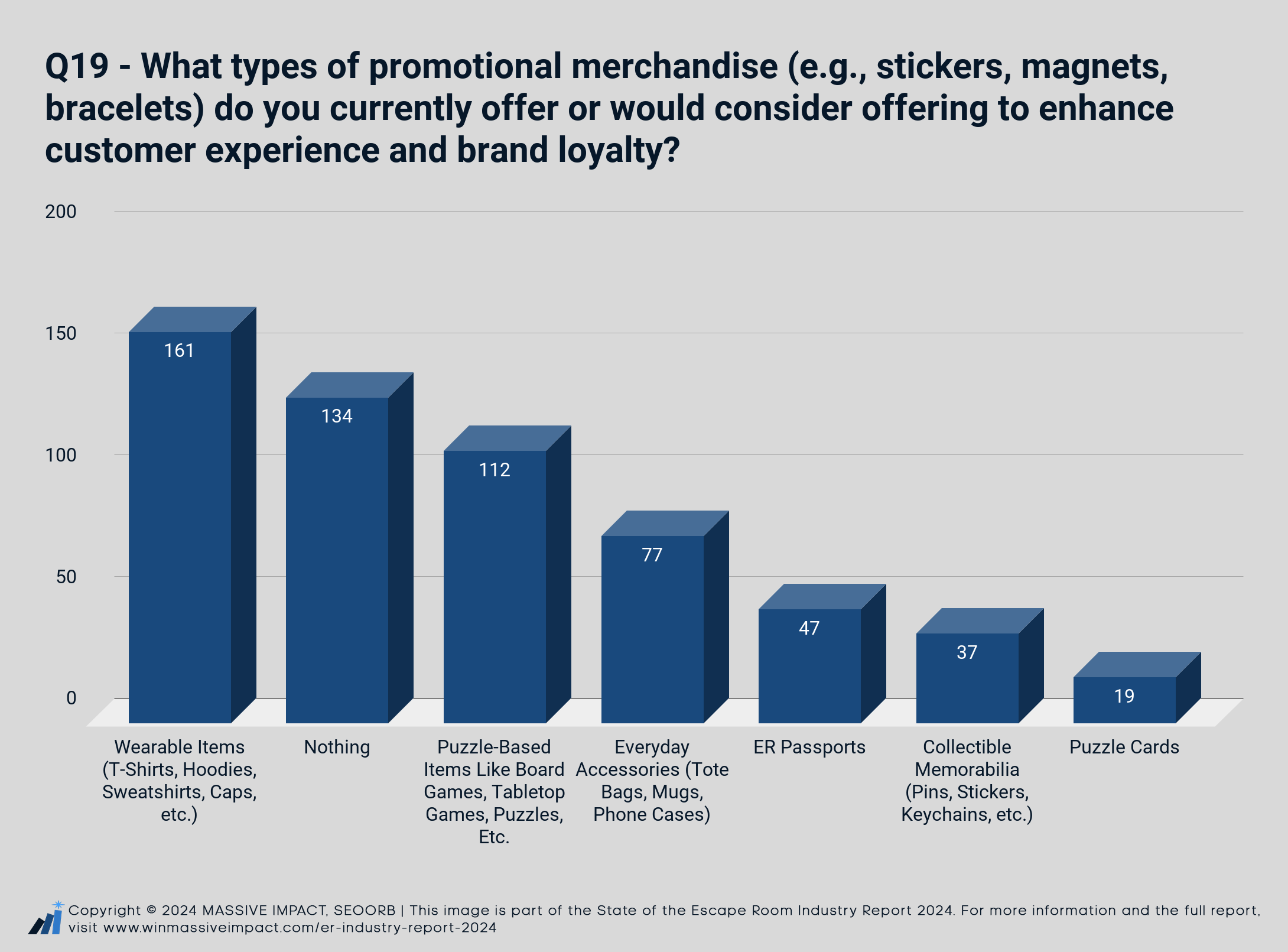

Q19 – What types of promotional merchandise (e.g., stickers, magnets, bracelets) do you currently offer or would consider offering to enhance customer experience and brand loyalty?

Multiple-Choice Question with an Open-Ended Option.

Participants: 364

- 44.2% of businesses (161 respondents) are most interested in wearable items such as t-shirts, hoodies, and caps, making this the most popular category.

- 30.8% (112 respondents) would offer or already offer puzzle-based items like board games, tabletop puzzles, or similar products, which can complement the escape room experience.

- 21.2% (77 respondents) favor everyday accessories like tote bags, mugs, or phone cases, which serve as practical and branded merchandise for customers.

- 12.9% (47 respondents) mentioned interest in offering ER passports, a unique form of memorabilia that encourages repeat visits.

- 10.2% (37 respondents) focus on collectible memorabilia like pins, stickers, or keychains, which can be affordable, small souvenirs for guests.

- 5.2% (19 respondents) offer or consider offering puzzle cards, a unique and thematic item aligned with the puzzle-based nature of escape rooms.

Notably, 36.8% of respondents (134 businesses) indicated that they do not offer any merchandise. This could suggest either a lack of interest or awareness of how branded items can enhance customer loyalty, increase brand recall, and boost customer retention.

It could also reflect challenges such as a lack of availability or knowledge on how to source promotional items. Smaller businesses may not know where to find reliable suppliers or may feel that branded merchandise is beyond their reach due to cost or logistics.

Other things that couldn’t be bucketed into any other category:

- Bonus round prizes

- Physical book with web app product

- Food items

- Mini Trophies

- Themed Game Reports

- Mini Trophies

- Tattoos

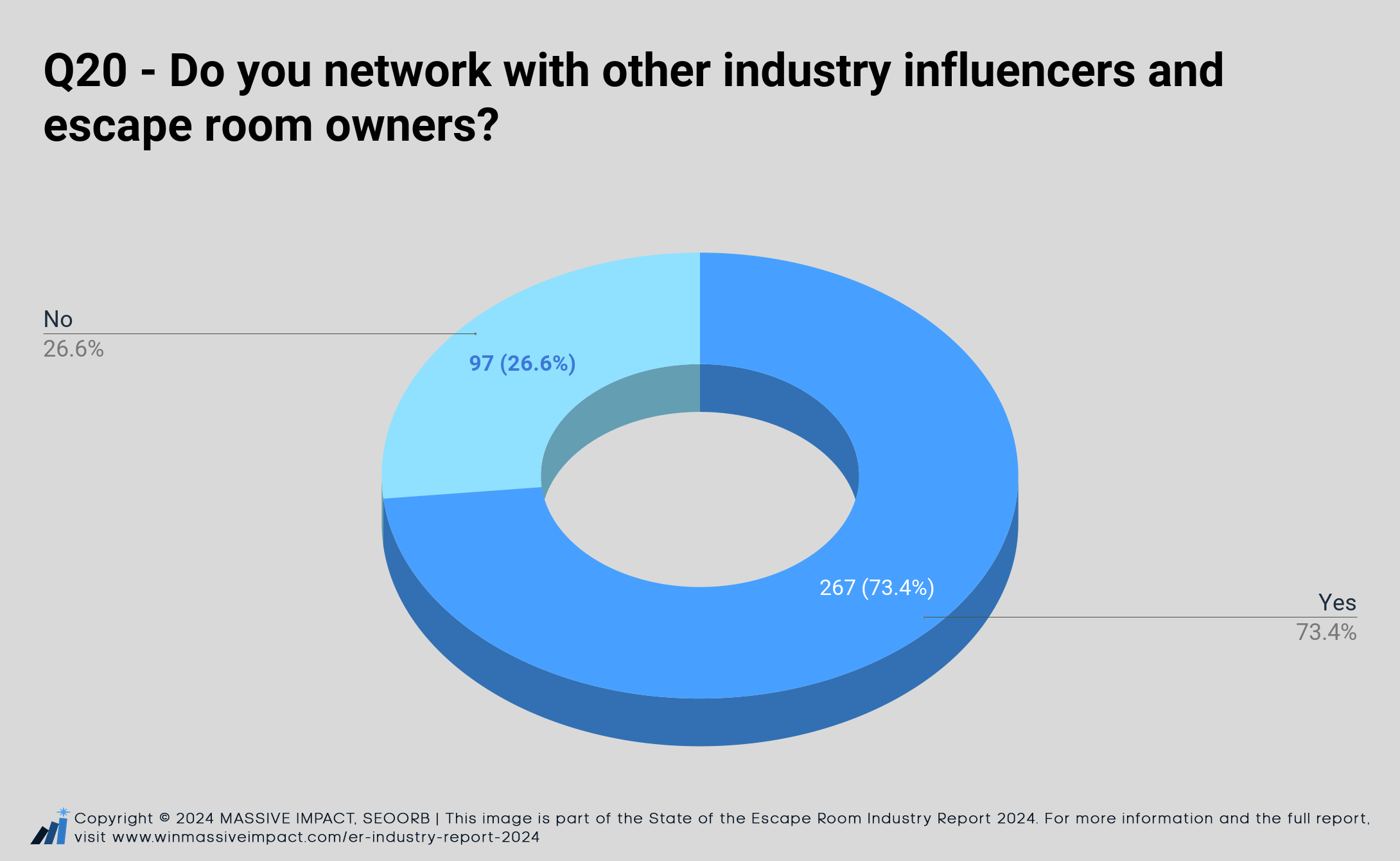

Q20 – Do you network with other industry influencers and escape room owners?

Single-Choice Question.

Participants: 364

A significant 73.4% of respondents (267 out of 364) indicated that they do network with other industry influencers and escape room owners. This high percentage reflects a collaborative and interconnected industry, where knowledge sharing and relationship building are essential for growth, innovation, and staying competitive.

In contrast, 26.6% of respondents (97 businesses) reported that they do not engage in such networking activities. This could point to potential barriers, such as a lack of time, resources, or awareness of networking opportunities, that prevent these businesses from connecting with the broader industry.

Overall, the data highlights the importance of collaboration within the escape room community and suggests that those who actively network may benefit from shared insights, partnerships, and industry developments that could enhance their business performance.

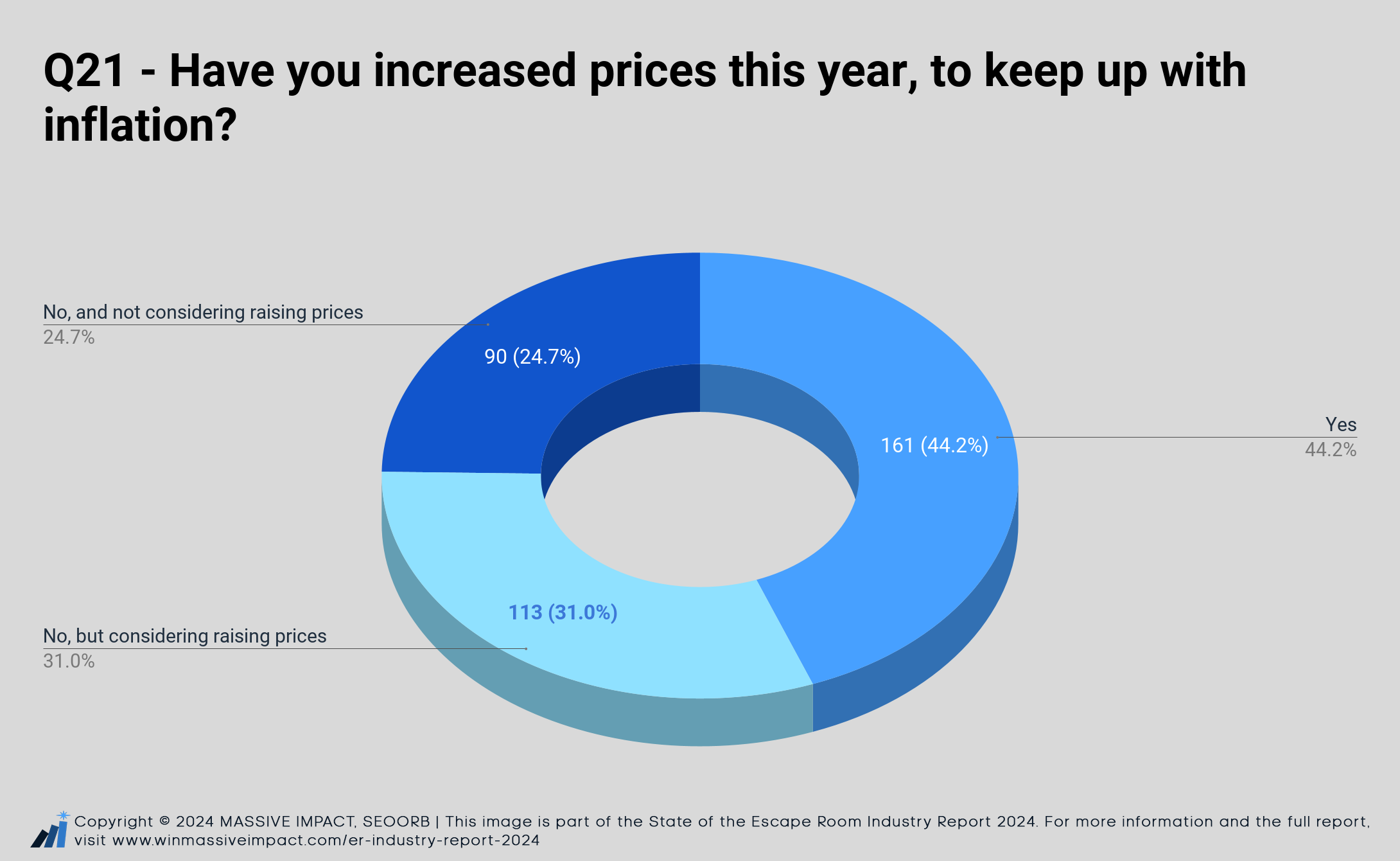

Q21 – Have you increased prices this year, to keep up with inflation?

Single-Choice Question.

Participants: 364

The survey results for Question 21 reveal that 44.2% of respondents (161 out of 364) have raised their prices this year to keep up with inflation. This indicates that a significant portion of escape room businesses are adjusting their pricing to address rising costs and economic pressures.

Additionally, 31% of businesses (113 respondents) have not raised prices yet but are considering doing so, indicating that many operators are still weighing their options as they navigate the current economic climate.

However, 24.7% of respondents (90 businesses) have not increased prices and are not considering doing so. Notably, only 6 of these respondents reported no challenges affecting their business. The remaining 84 businesses are still facing issues, with 50 of them citing generally reduced customer spending as a key factor impacting their operations. This suggests that some operators may be hesitant to raise prices out of concern that it could further deter customers, especially when consumer spending is already down.

This data suggests a divided approach: while many businesses have responded to inflation with price increases, a substantial number remain cautious, potentially fearing that price hikes could further impact customer demand. The hesitation among those affected by reduced customer spending highlights a delicate balance between maintaining profitability and staying competitive in a challenging economic environment.

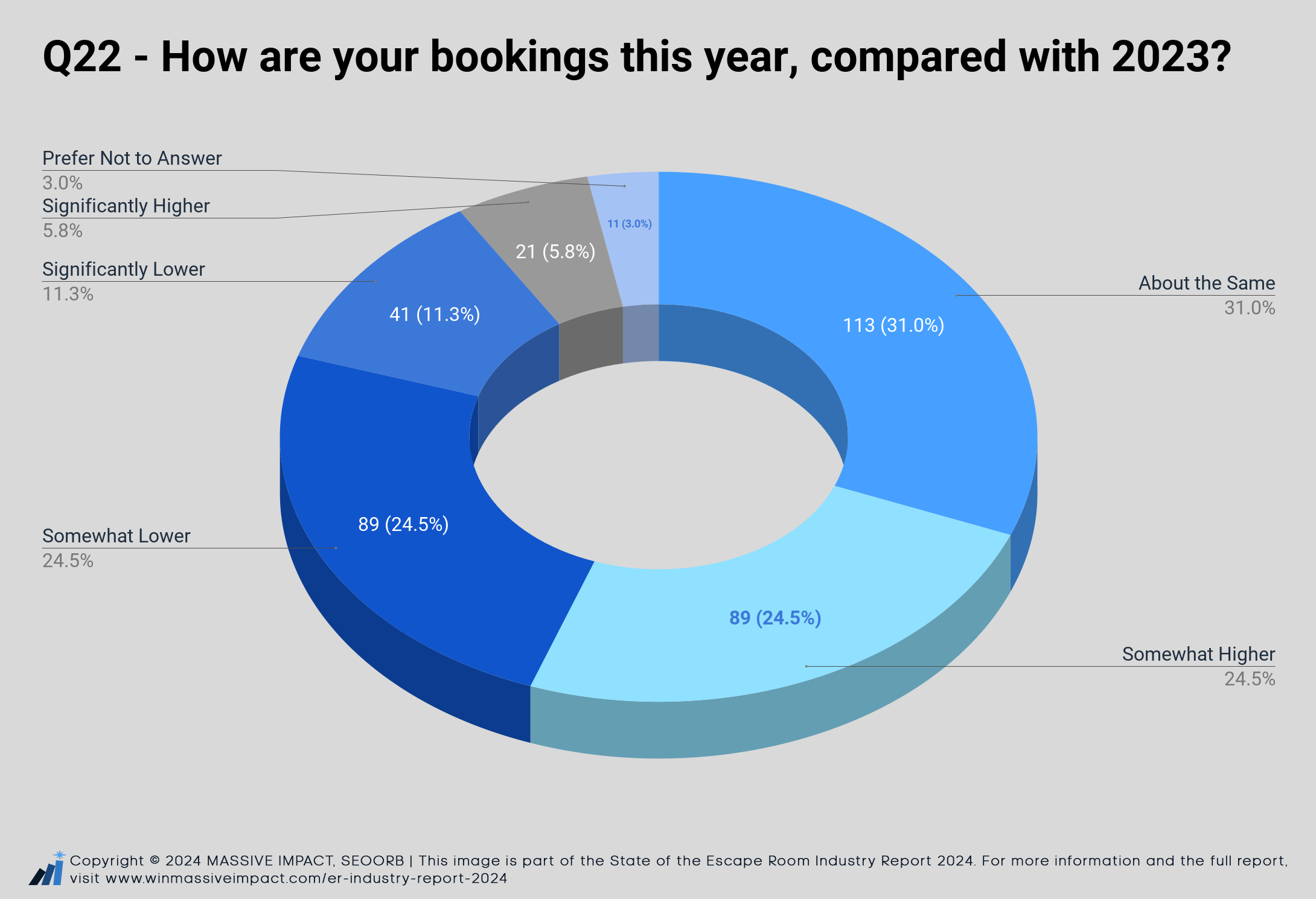

Q22 – How are your bookings this year, compared with 2023?

Single-Choice Question.

Participants: 364

This question paints a nuanced picture of the escape room industry’s performance amid changing economic conditions. The data highlights significant divergence in business performance, suggesting both structural shifts and external economic pressures at play.

Breakdown of Results:

- 31% of respondents report that their bookings are “about the same” as 2023 (113 businesses).

- 24.5% of businesses saw “somewhat higher” bookings (89 respondents).

- An equal 24.5% experienced “somewhat lower” bookings (89 respondents).

- 11.3% reported bookings as “significantly lower” (41 respondents).

- 5.8% indicated bookings were “significantly higher” (21 respondents).

- 3% preferred not to answer (11 respondents).

This data highlights a mixed performance in the industry, with nearly a third of businesses experiencing stable bookings, while the rest are split between moderate growth and declines. The notable point is the higher percentage of businesses reporting significant decreases (11.3%) compared to those experiencing significant increases (5.8%). This suggests that although some businesses are thriving, a larger proportion is facing challenges in growing their customer base.

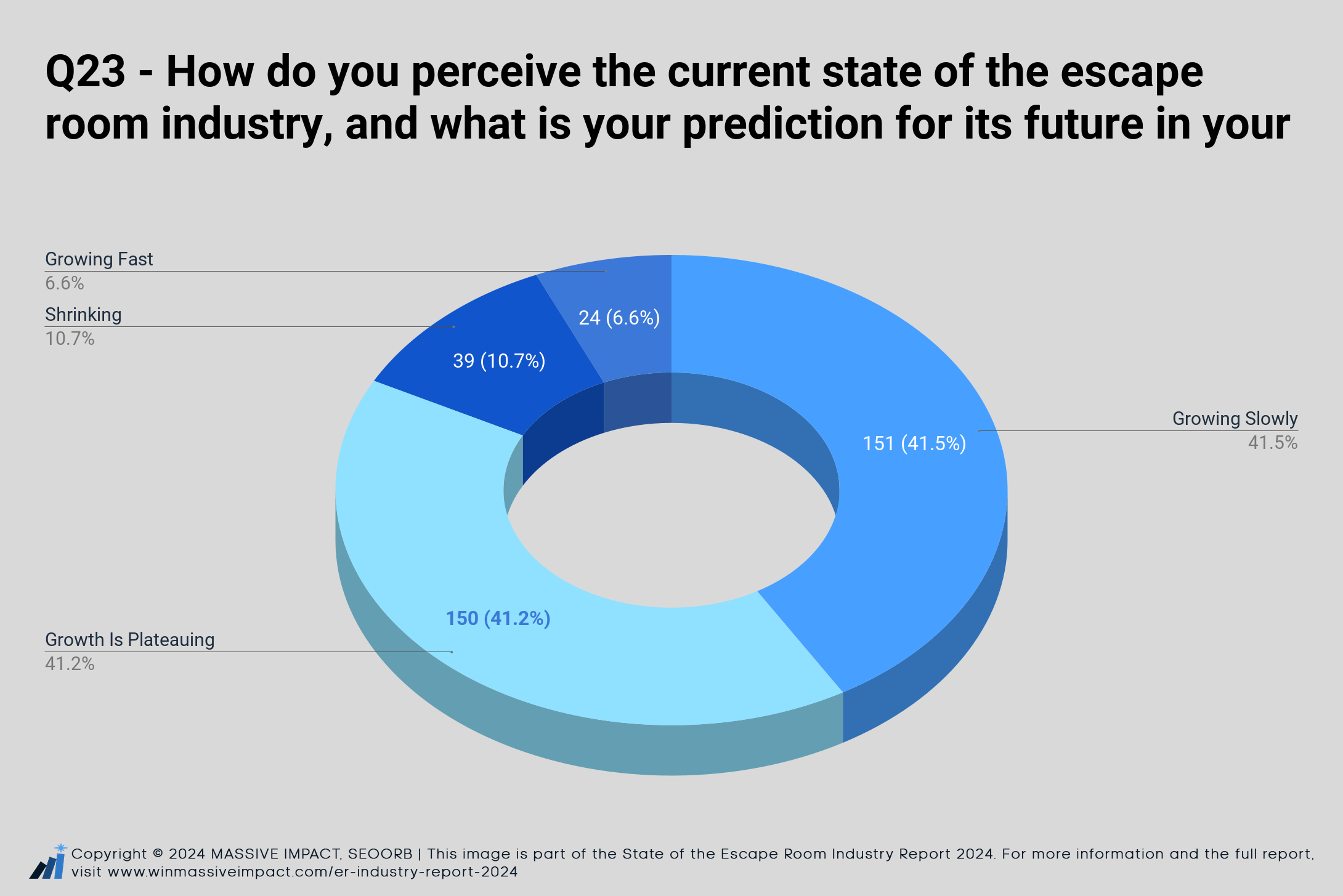

Q23 – How do you perceive the current state of the escape room industry, and what is your prediction for its future in your area?

Single-Choice Question.

Participants: 364

The survey results for Question 23 present a wide range of perspectives on the current state of the escape room industry:

- 41.5% of respondents (151 businesses) believe the industry is growing slowly, indicating gradual but steady development.

- 41.2% (150 businesses) feel that growth is plateauing, suggesting that many operators see the market stabilizing, with limited expansion opportunities.

- 10.7% (39 businesses) report the industry is shrinking, indicating struggles in certain areas, potentially due to economic conditions or market saturation.

- 6.6% of respondents (24 businesses) see the industry as growing fast, reflecting rapid expansion in select regions or markets.

The data suggests that while the escape room industry is still growing, much of this growth is slow or leveling off, with fewer regions seeing rapid expansion. Many businesses reporting plateauing growth point to a maturing market with fewer new players and increased competition.

Those experiencing shrinking growth may be facing challenges due to economic downturns or market saturation, with economic conditions and reduced consumer spending impacting businesses across the sector.

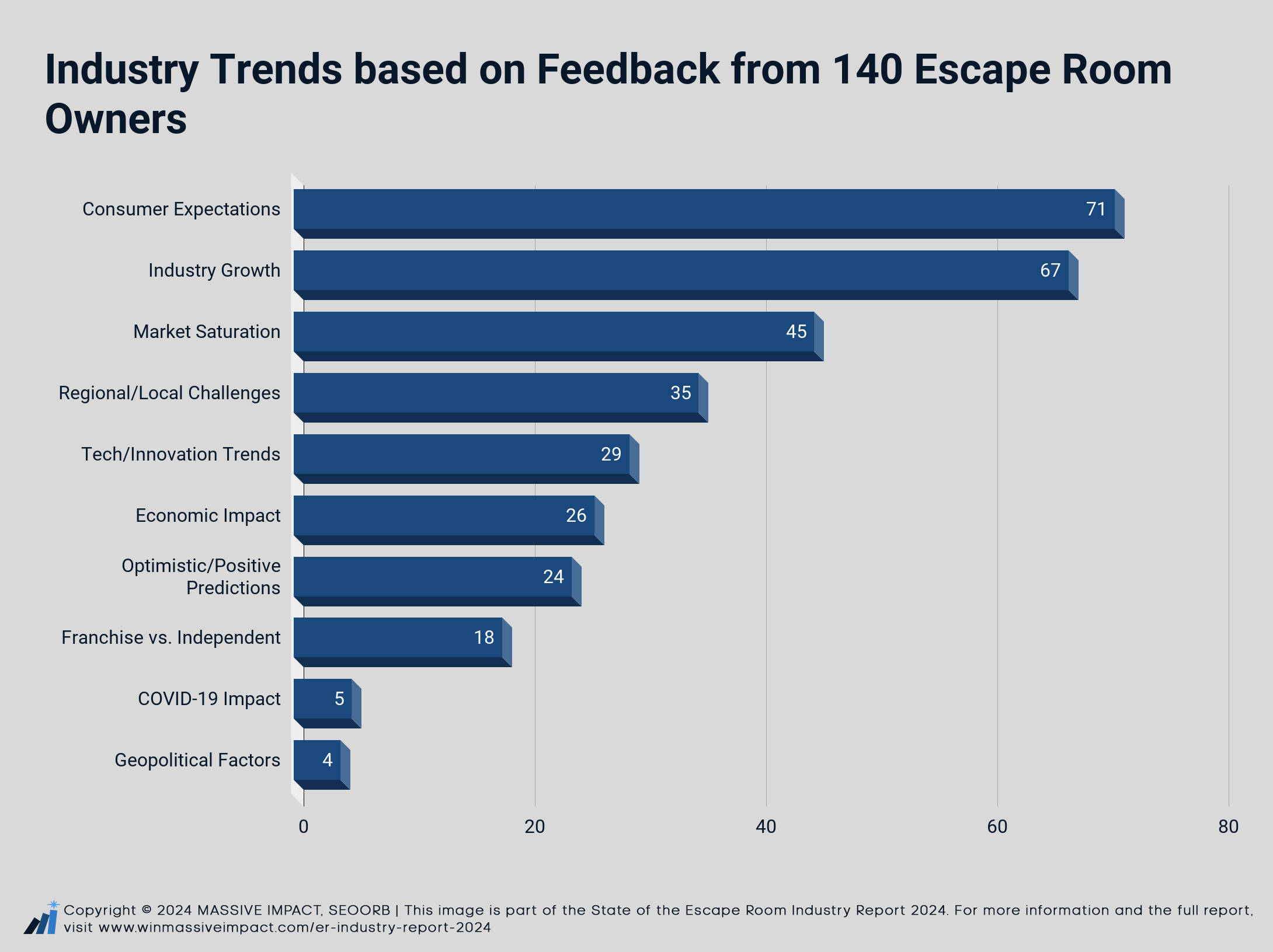

Q24 – Based on your reply in the previous question. Would you like to share any thoughts on the growth of the industry and any predictions? (this is optional)

Open-Ended Question.

Participants: 140

| # | Q24 - Based on your reply in the previous question. Would you like to share any thoughts on the growth of the industry and any predictions? (this is optional) | Trend Categories | City | Region | Country |

|---|

Respondent Thoughts on Industry Trends—Tabulated

COVID-19 Impact

While the COVID-19 pandemic significantly disrupted the industry, its effects are now seen as longer-term impacts. Many businesses report slower recoveries, closures, or the need to offer private events as a result of the pandemic. However, COVID-19 was only mentioned 5 times, showing its reduced influence compared to more pressing concerns.

- Example: “Since the pandemic, not many new games have been launched, and many have closed during or after that period.”

- Example: “COVID-19 helped us somewhat, as people began seeking private group events.”

Economic Impact

Many operators note that reduced disposable income and inflation are impacting customer spending on entertainment. Owners are finding that customers are forced to prioritize essentials like groceries over leisure activities. This is especially true in regions where the cost of living has spiked. This was mentioned 26 times, highlighting the significant financial pressure on both consumers and operators.

- Example: “The choice used to be between doing an escape room or going to the beach. Now, it’s between doing an escape room or buying groceries.”

- Example: “The US economy is very weak right now. We notice significant drops in bookings during the first weeks of each month.”

Consumer Expectations

Shifts in consumer expectations are becoming a key factor. Players are looking for more immersive experiences and high-quality rooms, leading to increased demand for novel and engaging puzzles. With 71 mentions, this was the most frequently discussed issue, as operators face the challenge of constantly improving their offerings.

- Example: “Customers are now seeking a complete experience and higher quality, which helps eliminate less impressive escape rooms.”

- Example: “People are becoming more selective with their spending and prefer games with a good reputation.”

Industry Growth

Despite multiple challenges like the slowing economy and maturing markets, many respondents still report growth in the industry, though at a slower pace. Industry growth received 67 mentions, showing that first-time players continue to enter the market, and there is optimism for further expansion.

- Example: “We still have 50% first-time players, which means new customers are entering the market.”

- Example: “I believe the industry has only tapped into about 15% of its potential market, so there is still significant room for growth.”

Technological/Innovation Trends

As the industry matures, businesses are increasingly focusing on technology and immersive experiences. The bar for production quality has risen, with top-rated escape rooms offering more complex environments and puzzles. Technological trends were mentioned 29 times, showing the importance of these advancements in staying competitive.

- Example: “The escape room industry has evolved from simple puzzle games to highly immersive experiences that often rival theatrical productions.”

- Example: “Players are expecting bigger and better games, but customers aren’t willing to pay more, especially considering inflation.”

Regional/Local Challenges

Some operators face regional challenges, such as market saturation or intense local competition. In some areas, too many rooms are opening, spreading customer spending too thin across multiple locations. Regional challenges had 35 mentions, indicating localized difficulties are a major concern in certain areas.

- Example: “There are currently five companies in town: three local and two chains. I know that two of the local companies are struggling.”

- Example: “In some areas, new rooms are better, but many escape rooms are closing.”

Market Saturation

Many owners report concerns about oversaturation in certain regions. Too many escape rooms are opening in some markets, resulting in competition that is diluting customer spending and creating difficulties for individual businesses to remain profitable. Market saturation was brought up 45 times, making it one of the most commonly discussed challenges.

- Example: “Too many new rooms are opening. The money customers spend is getting spread too thin across too many locations.”

- Example: “There seems to be a bubble in certain markets, and smaller companies that caused it in 2019 are disappearing.”

Franchise vs. Independent

The franchise vs. independent debate continues to affect the industry. Some respondents feel that independent escape rooms offer more unique and creative experiences, which give them an edge. However, franchises benefit from economies of scale and larger marketing budgets, which can overshadow smaller competitors. This topic came up 18 times, reflecting ongoing tension between the two business models.

- Example: “Escape room enthusiasts will continue to prefer independent escape rooms over franchises.”

- Example: “Corporate franchises have lowered the quality while increasing competition.”

Geopolitical Factors

A few respondents mentioned geopolitical issues, such as the ongoing wars in Israel and Ukraine, which have severely impacted their business operations and growth. However, geopolitical factors were mentioned only 4 times, indicating their limited impact on the industry overall.

- Example: “Given the ongoing war, business is understandably suffering.”

- Example: “If the war continues, the industry will be significantly affected and may face shutdowns.”

Optimistic/Positive Predictions

Despite these challenges, many owners remain optimistic about the future of the industry. Some believe that high-quality, innovative escape rooms will continue to thrive, and they anticipate further growth in the coming years. Optimistic predictions received 24 mentions, reflecting a hopeful outlook for businesses that can continue to innovate and adapt.

- Example: “We hope to expand in the coming years, but we anticipate slow growth.”

- Example: “The industry has matured, and those who have endured the past nine years are well-positioned to thrive for another nine.”

Q25 – Do you think the industry is over-regulated in your area in terms of compliances?

Single-Choice Question.

Participants: 301/364 – Answer: Participants who said “NO”

| Q25 - Do you think the industry is over-regulated in your area in terms of compliances? | Region | Country |

|---|

Participants: 63/364 – Answer: Participants who said “YES”

| Q25 - Do you think the industry is over-regulated in your area in terms of compliances? | Region | Country |

|---|

301 out of 364 respondents stated that the escape room industry was not over-regulated in their area.

Geographic Breakdown of Over-Regulated Areas

- United States: A significant portion of the feedback about over-regulation comes from the U.S., with 33 respondents across various states. California (10 cities) is particularly prominent, with several operators from cities like Los Angeles, Oceanside, and Fremont citing over-regulation. Other states with multiple mentions include Washington, New York, and Arizona.

- Europe: Respondents from Germany, France, Spain, Denmark, and the United Kingdom also noted over-regulation. Germany has four mentions from cities like Cologne and Hamburg, while France includes feedback from cities such as Montpellier and Toulouse.

- Australia: In Australia, both Sydney and Perth cited over-regulation, reflecting concerns in both New South Wales and Western Australia.

- Canada: There was a single report from Québec City, indicating that over-regulation is not as widespread in Canada compared to other regions.

- Israel: Operators in Haifa and Netanya also mentioned concerns about regulatory burdens in their areas.

- Other Countries: Additional responses came from Austria (Vienna), Greece (Peristeri), and the Netherlands (Naarden, Amsterdam).

Regional Insights

- United States: In the U.S., states like California, New York, and Washington are leading in complaints about regulatory challenges, particularly in metropolitan areas. In California, stricter fire safety, zoning laws, and business regulations are heavily enforced across both large cities like Los Angeles and smaller ones such as Ventura. Similarly, cities like New York City and Seattle in New York and Washington face regulatory hurdles tied to building codes, fire safety, and business licensing, which are common in areas with high concentrations of escape room businesses. These issues highlight the complexities of operating in states with more stringent compliance requirements.

- Europe: The feedback from cities across Germany, France, and Spain hints at stricter health and safety laws or specific industry-related compliance that differs from region to region. Germany, in particular, has been known for its strong focus on compliance and safety regulations, which may extend into the entertainment and recreation sectors.

- Australia: With two key cities reporting over-regulation, it suggests that escape room operators in Sydney and Perth may be facing stringent local business laws and compliance standards that could be adding financial or operational pressure.

- Israel: The mentions of Haifa and Netanya likely point to unique local conditions, where compliance and safety standards may be stricter due to external geopolitical or safety concerns.

Note: If you are planning to open an escape room in any of these regions, it is highly recommended to consult with existing escape room owners about regulatory requirements before finalizing your location and business setup. This proactive approach can help you navigate potential compliance issues more effectively.

Possible Regulatory Challenges

Based on the feedback and the geographic spread, the over-regulation mentioned by respondents may be influenced by:

- Fire and building safety codes: Escape rooms are often under scrutiny for meeting strict fire and evacuation safety standards.

- Zoning restrictions: Operators might face challenges related to where they can open their businesses within a city.

- Licensing and operational permits: Some regions may require specialized permits that are difficult or costly to obtain.

- Health and safety regulations: Particularly relevant post-pandemic, health-related compliance could be adding extra layers of bureaucracy.

While the majority of respondents did not feel over-regulated, the 63 responses from across the globe reveal a trend of geographic concentration in regions like California and Germany, where compliance requirements may be more stringent. This indicates that escape room operators in these areas might be struggling with navigating complex regulatory frameworks that could be affecting their operational flexibility and profitability.

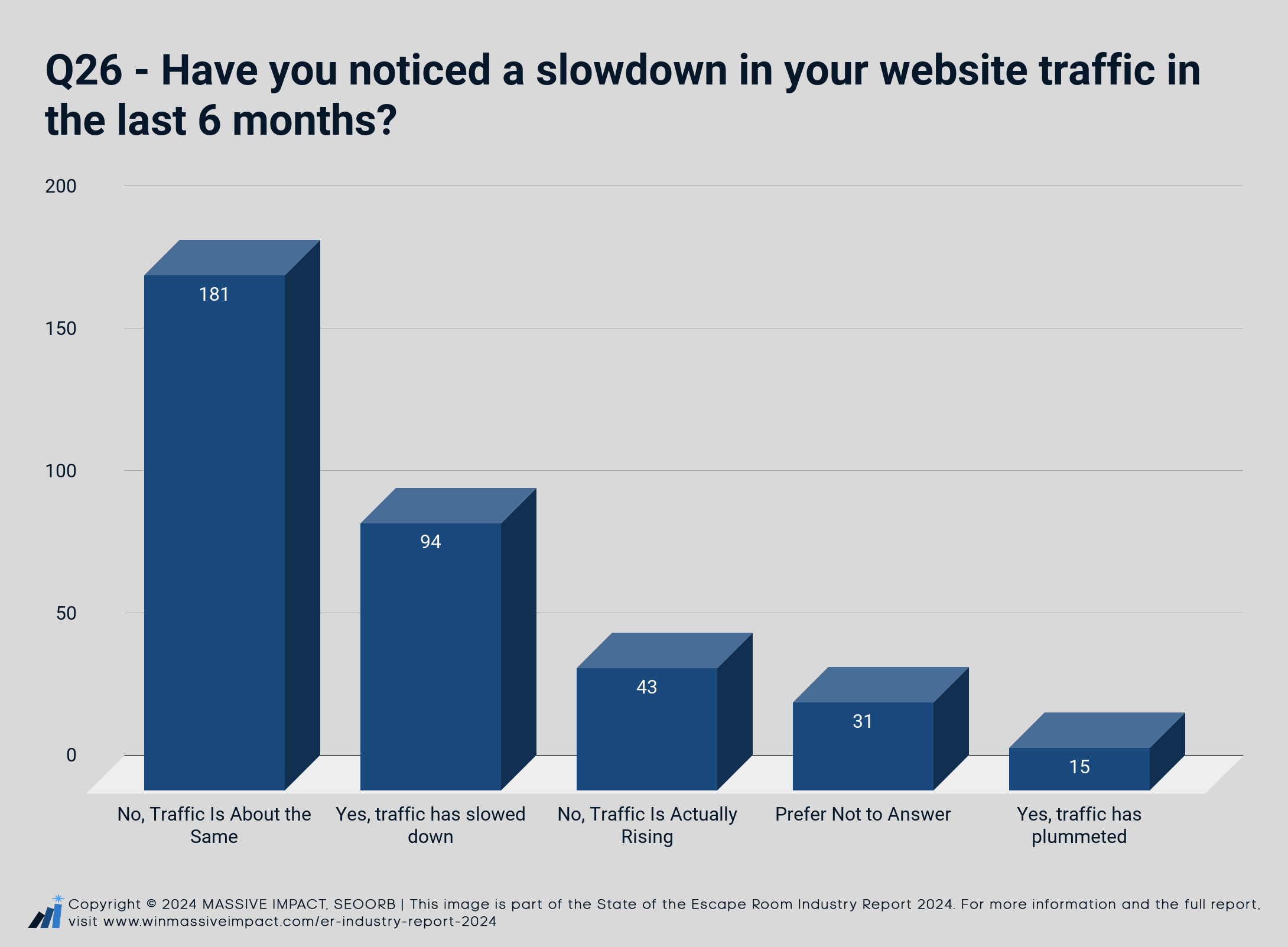

Q26 – Have you noticed a slowdown in your website traffic in the last 6 months?

Single-Choice Question.

Participants: 364

The survey results for Question 26 provide insights into recent trends in website traffic for escape room businesses:

- 50% of respondents (181 out of 364) indicated that their website traffic has remained about the same over the last six months, suggesting stability for a large portion of businesses.

- 43 businesses (11.8%) reported that their traffic is actually rising, which could indicate that these operators are successfully engaging with customers, perhaps through targeted marketing or improving their online presence.

- 31 respondents (8.5%) preferred not to answer this question, which could be due to various reasons, including privacy concerns or lack of clarity on their traffic data.

- 94 respondents (25.8%) reported that their website traffic has slowed down, and 15 businesses (4.1%) indicated that their traffic has plummeted.

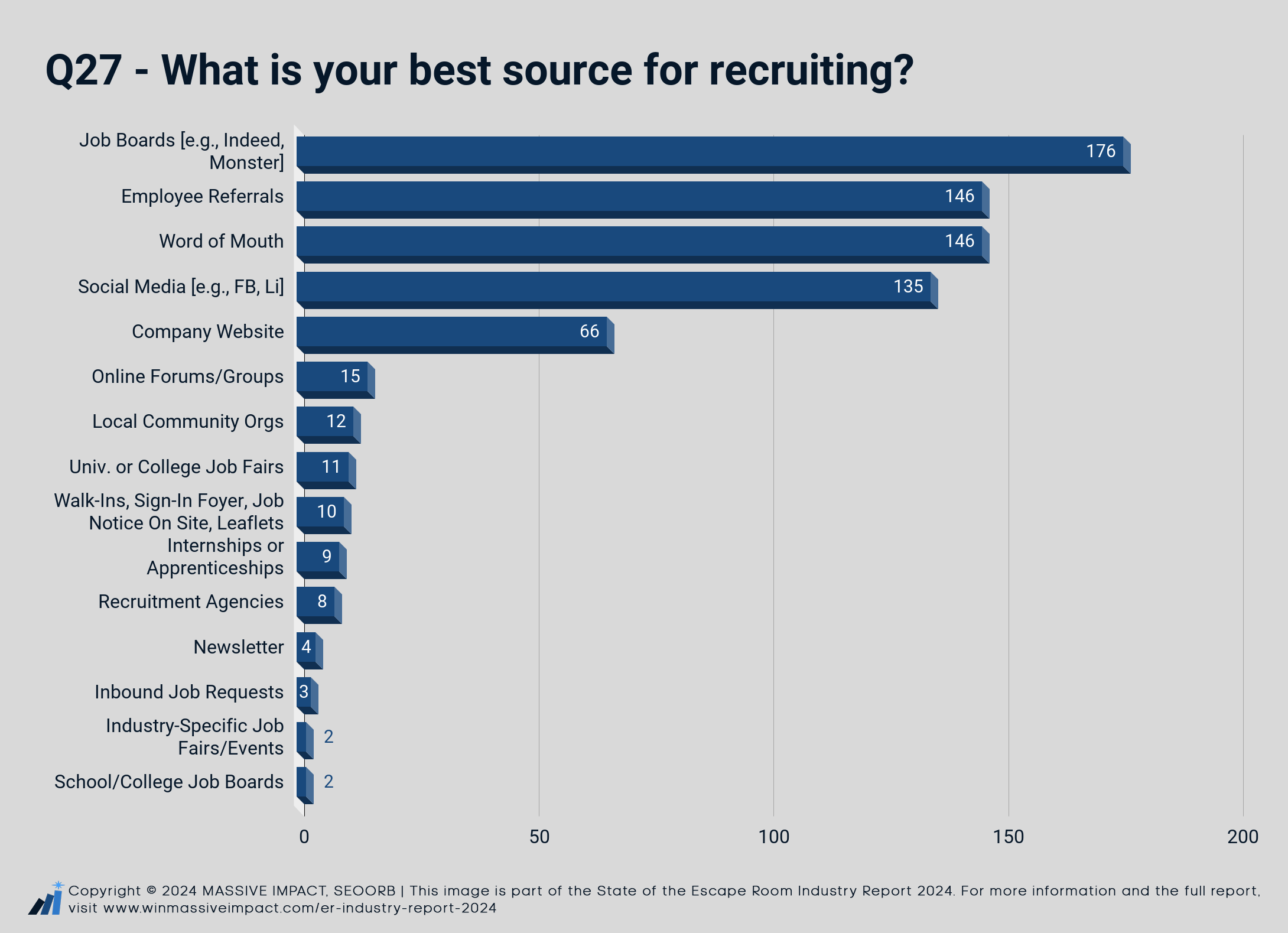

Q27 – What is your best source for recruiting?

Multiple-Choice Question with an Open-Ended Option.

Participants: 364

The survey results for Question 27 highlight a wide range of recruitment methods used by escape room businesses. A total of 744 responses were gathered from 364 participants, suggesting that many businesses utilize multiple sources to recruit staff. Here’s an analysis of the key findings:

Top Sources for Recruiting

- Job Boards (e.g., Indeed, Monster): 176 responses (47.2%) of respondents indicated that job boards are their primary source for recruitment. This suggests that many businesses are utilizing large-scale, well-established platforms to find candidates, which may be due to the broad reach and accessibility of these tools.

- Employee Referrals: Tied for the second most popular method, employee referrals also garnered 146 responses (40.1%). This indicates a strong reliance on internal networks which can be beneficial for attracting candidates who are pre-vetted and aligned with company culture.

- Word of Mouth: Also receiving 146 responses (40.1%), word of mouth is another significant recruitment method. This suggests that informal recommendations remain highly influential within the escape room industry, likely because escape rooms are often smaller, community-based businesses where personal connections are highly valued.

- Social Media (e.g., Facebook, LinkedIn): 134 responses (36.8%) reported using social media as a recruiting tool. Unlike job boards, which primarily attract candidates actively seeking jobs, social media platforms like Facebook and LinkedIn can reach both active and passive candidates, expanding the pool of potential hires.

- Company Website: 66 respondents (18.1%) cited their company website as a key recruitment channel. This implies that many escape room operators are leveraging their own online platforms to attract candidates directly, possibly to ensure more control over the application process.

Less Common Methods

- Local Community Organizations: Only 12 responses (3.3%) came from local community organizations, indicating that while some businesses are engaged with their local communities, this is not a primary recruitment source for most.

- University or College Job Fairs: While 11 respondents (3%) mentioned university or college job fairs, this method seems underutilized, even though it could be a valuable source for attracting younger candidates who may be more enthusiastic about part-time or flexible work.

- Walk-ins and Leaflets: 10 responses (2.7%) highlighted walk-ins or leaflet distribution as a recruitment method. This is often used by smaller businesses that want to attract local talent or individuals already familiar with the venue.

Other mentions that couldn’t be bucketed into other categories:

- Local theater community

- Handshake Platform for College Recruitment

- Improv school teams, acting students/graduates.

Q30 – What advice would you give to other escape room owners to help them grow their business and increase revenue?

Open-Ended Question.

Participants: 246

| # | Q30 - What advice would you give to other escape room owners to help them grow their business and increase revenue? |

|---|

SPECIAL THANKS TO OUR INDUSTRY SUPPORTERS

Buzzshot: Super charge your player messaging, automate your email marketing and get powerful actionable business intelligence. So much more than just easy waivers and beautiful photos! Get a free trial and find out what you’re missing at Buzzshot.com

Cerebro by Gai Bosco is a leading game designer with over 250 custom escape rooms created worldwide. Specializing in gamification for organizations, education, museums, and TV shows, he crafts unique experiences tailored to each client’s needs, budget, and audience, ensuring every project is fully bespoke and innovative.

Nadezhda Danabasheva (Nadia) – Fury Team Nadezhda Danabasheva, known as Nadia, is the captain of Fury Team and a passionate escape room enthusiast. She runs the blog. FuryEscape.com , where she shares her love for immersive experiences. As the TERPECA ambassador for Bulgaria, Hungary, Romania, and Serbia, and the ER Champ ambassador for Bulgaria, Nadia plays an active role in promoting escape rooms globally. She also serves as the President of ABER (Association of Bulgarian Escape Rooms).

Morty is a comprehensive platform designed for escape room enthusiasts to discover, book, and review escape room experiences worldwide. With its extensive database and user-friendly interface, Morty allows players to find new rooms, track their progress, and connect with the escape room community. It’s quickly becoming a go-to tool for enthusiasts looking for the best rooms and unique experiences globally. Visit morty.app

Zolitopia is a consulting company specialising in the escape room industry. It is owned and run by Zoli, a seasoned ER room owner with over a decade experience in the field. Zoli helped dozens of escape rooms in the UK and the USA since the inception of Zolitopia in 2021 with long term business development, marketing and building self sustaining teams.

TERPECA recognizes the best escape rooms in the world based on the votes of enthusiasts and expert players. Since its founding, TERPECA has grown into a leading authority in the industry, with thousands of participants contributing to the ranking process annually. Its mission is to celebrate excellence in escape room design and highlight the industry’s best experiences worldwide. Visit TERPECA: https://terpeca.com

The Escape Industry Newsletter is a free monthly newsletter covering all things escape room: Trending topics, new sites and rooms opening, interviews, podcast episodes and more. Visit: https://escapeindustry.com/

Mystery Unfolds are West Australian based creators of puzzle-centric products and services. Their flagship product, Puzzle cards, are an escape room experience in a birthday card. The recipient doesn’t get their gift until they’ve solved the mystery within. Visit: https://puzzlecard.org/

SOME OF OUR VALUED SURVEY PARTICIPANTS

A special mention to some of our respondents: We should mention that we got responses from South Africa, India, Taiwan and Singapore. Unfortunately, there were too few of them to reach any definitive conclusions about industry trends in those regions. However, those responses did help shape the global picture.

[email protected] www.Xcapery.com

Geoff ctrlaltesc.co.uk

Illuminati Escape, Berlin

MyssTic Rooms

Radu Ocrain, Gap the Mind Escape Rooms, Bucharest

www.teamx.koeln

Paradox Parlours Guildford/Woking – https://paradoxparlours.com

The Great Escape Zwolle

Phil – Pier Pressure & Escape Workshop – www.escapeworkshop.co.uk

Eric Johnson – 21 Keys Escapes (21KeysEscapes.com)

Escape Room Fayetteville

Puzzle Animations, Grenoble, France

Great Escape Game Beavercreek,OH

Incognito Escape Room (incognitoescaperoom.ie)

The Quandary Escape Chicago – https://quandaryescape.com

Wyjście Awaryjne

AdventurEscape Utrecht, www.adventurescape.nl

Benito Suppa

FOX-N-OTTER Escape Rooms

Devil’s Den Escape Rooms, Mechanicsville, MD, DevilsDenEscape.com

Encrypted Escape

Raphael Freeing France

ESCAPE ADVENTURES FRANKFURT https://www.escapeadventures.de

The Riddle Room, Best, The Netherlands, www.riddleroom.nl

Mike Whittle, Escapetown Peoria

Noam ravina

Questhouse & Rob the bank

Jorge – https://www.EscapeRoomPanama.com

Eric Barnett – XSCAPE! Morg

Abi Leon; Quest Escapes on all socials

Doctor Watsons NL

Team Escape Rooms

Unlock Adventures escape rooms in Ede, Netherlands

Josh Young – Escape Room Adventures

Jordan couch (Just escape room) justescaperoom.com La Grange, IL

The Escape Key www.escape-key.co.uk

Amazon Escape https://www.amazonescape.co.il/

The Box Escape Room, Ghent, Belgium www.thebox.gent

Secret Combinations Escape Rooms (Utah, https://secretcombinationsescaperoom.com/)

Bart Van Loon, https://scapegoat.be

Adam – Keylock games

ESCAPE! Alaska, www.escapealaska.com

Breakpoint Escape Rooms Stevens Point Wisconsin. www.pointescaperooms.com

Sebastian Hinkel

Sebastian – The Forsaken Archives Escape Rooms

Live Escape Salisbury

Captivate Escape Rooms, Singapore

Loran Laus

Extreme Escape Redding and Extreme Escape Elevated www.extremeescaperedding.com

Conundroom Real Escape Rooms conundroom.us

LOKT Escape Rooms – www.loktescaperooms.com.au

Locked In Escape Rooms

Damian Bowden – Owner of Project Immersive – www.projectimmersive.com

Mission Evasion Lyon (FRANCE) : www.missionevasion.fr

Nico Cesar https://redfoxescapes.com

Kat Graepel, Owner of The Codex Escape Rooms and TROLL Escape Rooms Bucharest www.thecodex.ro www.gameoftrolls.ro

Puzzalogical Escape Rooms. Bracknell Uk

Waxhaw Escape, waxhawescape.com

Zoli | Co-Owner at clueQuest | cluequest.co.uk

Exitus:Salem Escape Rooms

Vancouver Mysteries Inc – Bring a outdoor mystery experiences to your town, contact us at vancouvermysteries.com

Funky Monkeys Escape Hub Sofia Bulgaria

L’Issue Jeu d’évasion. www.lissue.ca

Mad Machines

Jonas Grimberg, RSCAPE, Remscheid Germany, www.rscape.de

Matthew at Boerne Escape Rooms Boerne Texas

Mallory Lynch, Co-Founder / Owner / Chief People Officer Puzzol Creative www.puzzolcreative.com, www.memphisescaperooms.com, www.theadventuremuseum.com, www.theescaperoom.com/florence

Escape Maze – Peterborough ON Canada

Hidden Gems Escape Room in Richmond, Va. hiddengemsescape.com

Mysticroom

The Door, Lausanne, Switzerland

Intrepid Escape Rooms, Orange County, California

Puzzle Break Powered by PanIQ (America’s First Escape Room Company) https://puzzlebreak.us/seattle/en

Twisted Limits Escape Rooms

MISSION EXIT missionexit.com 4 rue d’Alger Montpellier FRANCE 0499639609

ESCAPEDIEM Live Escape Room https://escapediem.de/

Www.theexitroomkc.com; www.thepuzzleparlour.com

Boggled Escape Rooms

Mark and Bonnie Lesney, Owners, Trapped in the Upstate Escape Rooms https://trappedupstate.com/

Live Action Escapes

THE CHAMBER Real-Life Gaming – Prague, CZ; www.thechamber.cz

https://exitusvr.com/ we are a virtual reality escape room and arcade in Houston, TX

Tom Stockton – National PR Manager at Breakout Escape Rooms UK (Liverpool, Manchester, Chester)

Escape 60 Live Escape Room Adventures www.escape60peoria.com [email protected]

Elusive Escape Games, AuGres MI 48703 www.elusiveescapegames.com Lenny and Michelle Svanberg

Outta Time eXcape rooms, Charleston WV www.outtatimeexcape.com

The Puzzle Parlour

The Puzzler Escape Rooms

Escape This Frederick, escapethisfrederick.com in Frederick Maryland

Ethan Boling, Emerge Escape Rooms in La Grange KY, playemerge.com

What should be included? Tom Hemenway [email protected] or a link to timebanditescape.com ?

Escape Rooms Unlocked

William James at brainxcape.com

PARADOXsquared Adventure Escape Rooms PARADOXsquared.com

Robert Nelson, Owner of The Escape Adventures, www.theeescapeadventures.com

Olga, www.open-the-door.co.il

www.escapeabilitylv.com, ESCAPEability, [email protected]

Liliya Mollova – 3KEY Rooms (Sofia, BG) – https://3keyrooms.com/en/

Open The Door Escape Room, Vienna, Austria, https://www.openthedoor.at

Victor van Doorn, Sherlocked Amsterdam – www.sherlocked.nl

0 Comments